WHY DO SCOTLAND’S EMERGENCY SERVICES PAY VAT?

24 October 2017

Why did the 2012 legislation creating Police Scotland result in the loss of the VAT rebate enjoyed by the local constabularies?

Context

In September 2012, the Scottish Parliament legislated for the creation of Police Scotland and the Scottish Fire and Rescue Service – unified bodies amalgamating eight existing regional forces. Intended to provide administrative efficiencies, as well as satisfying the SNP government’s desire to centralise, the creation of a single force for each service resulted in the loss of the VAT rebate enjoyed by the local constabularies.

Estimated to cost the Scottish taxpayer £35m per annum1, the loss of the VAT rebate has become a contentious political issue. The SNP government claims it as evidence of Westminster’s bias against Scotland and the opposition parties blame the SNP for the manner in which the forces were created.

Why was the rebate lost?

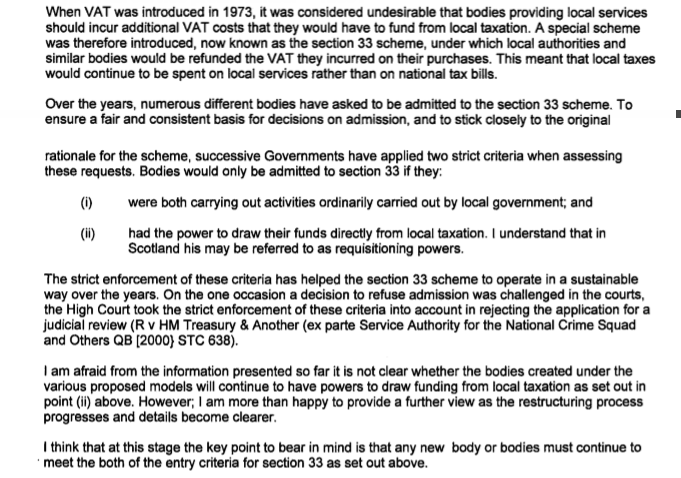

Perhaps the simplest way to explain this is to understand why regional forces received a rebate in the first place. That comes from the introduction of Value Added Tax in 1974 when the UK joined the European Common Market. In line with the principle that local taxes should not pay for national taxes, any local authority funded by local revenue could claim a rebate on all VAT it paid on non-business functions. This rebate was codified in section 33 of the VAT Act 1994.2

Scotland’s eight regional forces for police and fire were, until 2013, funded by Scottish councils - themselves partially funded by local taxation - and therefore qualified for the VAT rebate. When both services were centralised, the funding reverted to central government in Edinburgh and the right to an s33 rebate was lost.

This eventuality was well-known to the SNP prior to centralising the emergency services and was extensively discussed in correspondence between the Scottish Government and the Treasury, as revealed by a UNISON Freedom of Information request3 (on appeal).

UNISON themselves included a warning of the rebate loss during the consultation phase and suggested an alternative management structure that would result in less direct ministerial control of the new bodies but retain the rebate.4 The warning was ignored.

Similarly, the Treasury made it clear it would work with the Scottish Government to amend the reforms in such a way as to retain the rebate, albeit warning that a hardline stance had been applied historically in interpreting s33 rebates (citing the example of the National Crime Squad’s desire for a judicial review3).

The Politics

Several SNP politicians have gone on to claim that the Scottish situation is anomalous5, that other bodies within the UK receive VAT rebates despite not meeting the criteria stated and that Police Scotland and SRFS should receive the same treatment.

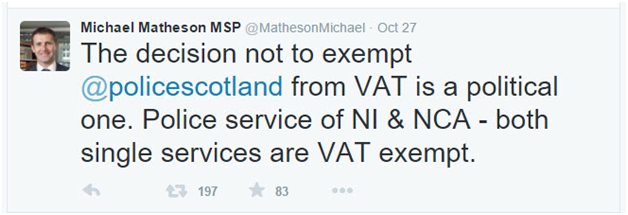

Michael Matheson, Minister for Justice in the Scottish Government since 2014, provides a typical example - here claiming that both the Police Service of Northern Ireland (PSNI) and National Crime Agency (NCA) were VAT exempt and therefore provide a precedent for Police Scotland. Neither comparison holds water, as Mr Matheson should well know.

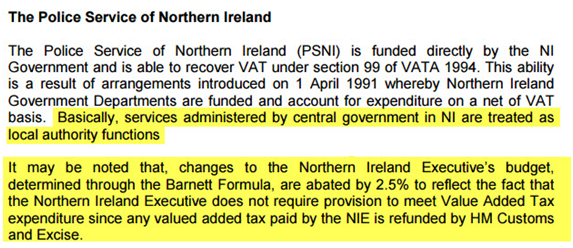

PSNI do not qualify for an s33 VAT rebate. All spending by the Northern Irish Executive is treated as if from a local body and therefore provides PSNI with an s99 rebate on VAT. However, all Barnett consequential increases to the Northern Irish block grant are abated by 2.5% to offset this ability to reclaim VAT. So PSNI do effectively pay VAT, only from the top line rather than the bottom. A fact that was made clear to the Scottish Government in the SPICe report to the audit committee on police reform.

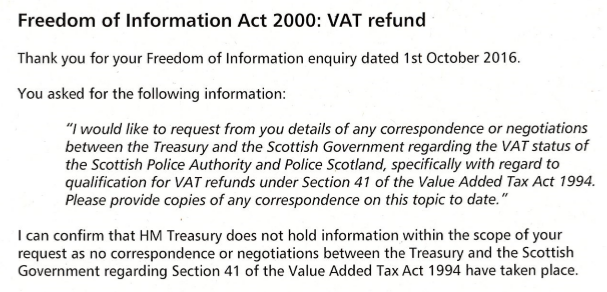

In the NCA’s case, they do not receive a full VAT rebate at all. In fact, they only qualify for an s41 rebate for ‘contracting out services’6 and “in general… input tax is not recoverable”.7 The Scottish Government has never sought or discussed the possibility of an s41 rebate with the Treasury or HMRC.8

Indeed, there are many examples of police services who face similar VAT restrictions, with the British Transport Police, the Civil Nuclear Police Authority and the Ministry of Defence Police all unable to reclaim VAT.

Can This Issue Be Resolved?

Is there scope for flexibility in the regulations and could the Treasury conceivably reinstate Scotland’s emergency services’ VAT rebate with, as some nationalists claim, a “stroke of a pen”9? After all, exemptions have been granted in recent years for Highways England and English academy schools.

Neither comparison is perfect. Highways England’s rebate is, similar to the NCA, for s41 “contracted out” services only and a far cry from the full rebate s33 allows. English academy schools are a closer comparison but have been granted an exemption because they operate alongside, and in competition with, locally funded schools who are in receipt of a rebate. Imposition of VAT would therefore create a competitive disadvantage for academies and negate the policy entirely - not an argument that can be made for emergency services.

During correspondence prior to the establishment of Police Scotland, the Treasury repeatedly stressed the “very repercussive significant risks” and “potentially costly precedents” of granting a VAT refund for the unified force.3 There may also be a consideration for EU law, with 0.3% of VAT receipts going on to pay for the EU’s institutions, at least until Brexit.

Yet some tax experts have argued that “the criteria are inevitably somewhat elastic”10 and the Scottish Tories appear to be making an exemption a condition of their 13 MPs supporting Phillip Hammond’s next budget.11

Somewhat ironically, were the Scottish Tories to succeed where the SNP have thus far failed, they may do little more than leave the Treasury open to accusations that their earlier decision was entirely unnecessary, perhaps even politically motivated.

Whatever happens next, there is no doubt that the Treasury’s position was well known to the Scottish Government prior to the reforms. It is simply not possible to credibly argue that the loss of the VAT rebate was anything other than a risk the SNP willingly accepted.

____________________________________________

Explanatory note on VAT exemptions:

Three sections from the 1994 Value Added Tax Act are mentioned in the article above. Their effect can be summarised as follows:

Section 33 - codifies the principle that local taxation should not be used to pay for national taxation. Allows any body which performs activities ordinarily performed by local government and is at least partially funded from local taxation to reclaim all VAT on non-business activities. Such bodies can therefore claim a rebate on VAT spent on purchasing supplies and services.

Section 41 - provides a VAT rebate for central government bodies procuring "contracted out services", i.e. services which could be performed in-house but are instead externally sourced - e.g. IT services or cleaning. The VAT rebate prevents private service providers being competitively disadvantaged simply by virtue of imposing VAT. This is much more restrictive than s33 and does not allow VAT on supplies to be recovered.

Section 99 - allows the same rebate as Section 33 where funding is provided by the Government of Northern Ireland, treating such funding as if it were from local government. However, Barnett consequential increases to the Northern Irish block grant is abated by 2.5% - so the VAT rebate is, in effect, cancelled out. (FYI - Police Scotland's VAT bill for 2015/16 was 2.58% of their budget.)

NOTES

-

Police and fire VAT Scottish Government Press Release 14th February 2017

-

Value Added Tax Act 1994 The National Archives

-

Scottish Government Freedom of Information Archive

-

Treasury confirms VAT bill for single fire and police services Scottish Unison Press Release, 14th March 2012

-

Other examples include: VAT treatment of the Scottish Police Authority and the Scottish Fire and Rescue Service Finance Bill – in a Public Bill Committee, 7th July 2016, Kirsty Blackman, and Clause 15 — Assignment of VAT Bills Presented — Local Area Referendum (Disposal of School Playing Fields) – in the House of Commons, 29th June 2015, Dr Philippa Whitford and Stewart Hosie

-

VAT Government and Public Bodies HMRC internal manual, 29th February 2016

-

National Crime Agency, Annual Report and Accounts 2014-15

-

Freedom Of Information Response:

-

Police chief urges SNP's 56 MPs to help axe crippling and unique VAT bill facing Scottish force The Herald, 27th May 2015

-

VAT anomalies and suggested changes Tax Journal, 16th May 2012

-

Chancellor’s own MPs urge him to scrap police VAT bill The Sunday Post, 8th October 2017

Please log in to create your comment