FISCAL TRANSFERS AND SHIFTING NARRATIVES

17 July 2020

In a piece first published by Reaction, These Islands chairman Kevin Hague explains how the United Kingdom is bound together by fiscal transfers.

This piece was originally published by Reaction on 15th July 2020.

The economist John Maynard Keynes is often quoted as saying “When facts change, I change my mind. What do you do sir?”

It seems that when it comes to the subject of the fiscal transfers which result from UK-wide pooling & sharing, supporters of Scottish independence would answer: “I change the narrative to avoid having to change my mind, sir”.

In the 1980s, by laying claim to the riches flowing into HM Treasury from North Sea oil, Scottish nationalists could justifiably argue that Scotland was a large net fiscal contributor to the UK. This provided them with a very simple, albeit unashamedly selfish, rallying cry: It’s our oil - Scotland should be independent!

During the 2000s, with a little bit of wishful thinking and some judicious timing, those same nationalists could argue that funds sometimes flowed one way, sometimes the other. So the narrative changed, but of course the conclusion remained the same: We pay our way - Scotland should be independent!

Now, with North Sea oil revenues a relative trickle and the Barnett Formula protecting higher public spending, Scotland is a clear net beneficiary of fiscal transfers from England. Scottish nationalists remain undaunted however because, apparently, being beneficiaries of a system which involves sharing must be a sign of failure: The UK clearly isn’t working - Scotland should be independent!

To rise above this tedious rhetorical shape-shifting, we need to understand why these fiscal transfers arise and what they tell us about the underlying economic performance of the UK’s constituent parts.

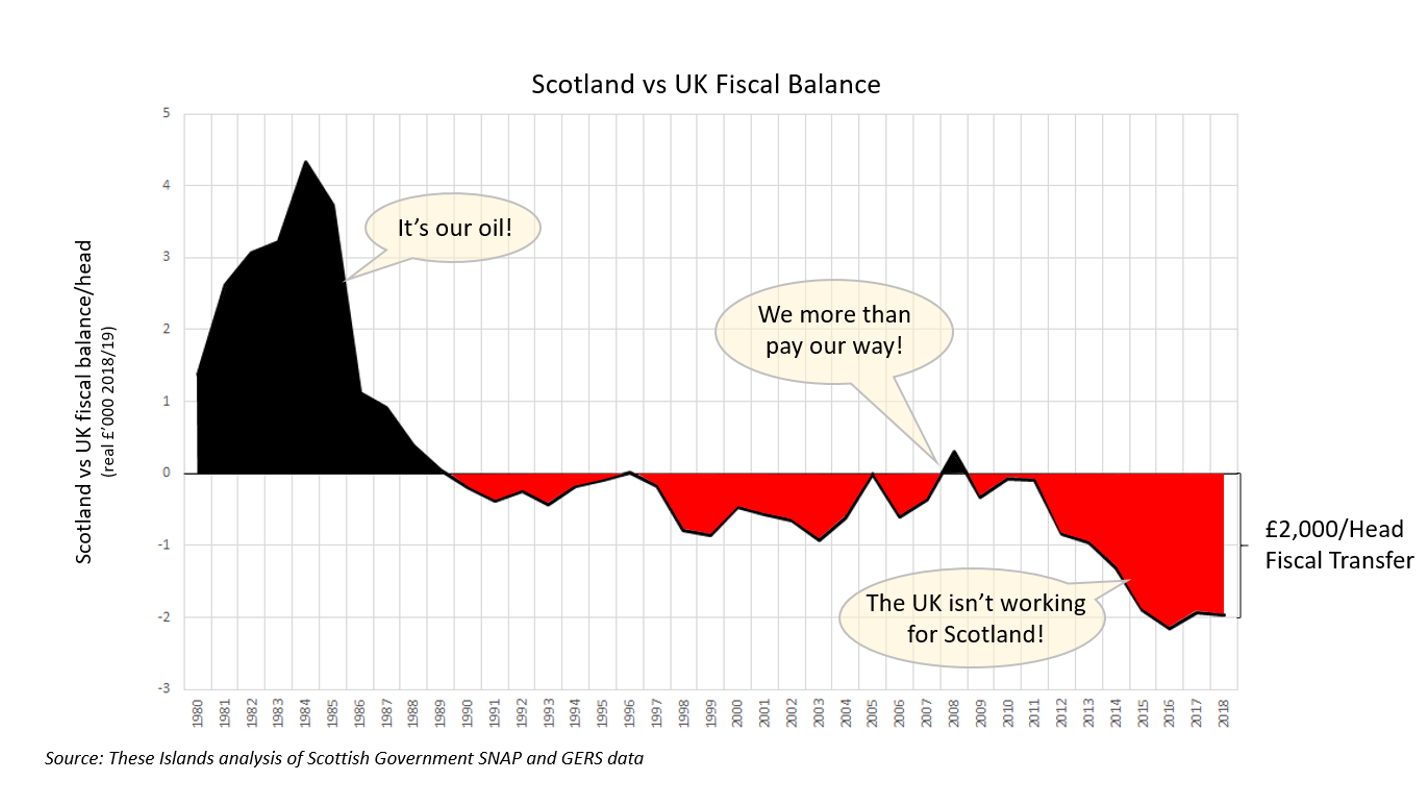

The graph below calculates the implied fiscal transfers between Scotland and the rest of the UK, using historical data published by the Scottish Government. The black areas show when Scotland has been a net fiscal contributor to the UK, red a net beneficiary. It shows the journey from the oil boom of the 80s through to the situation today where Scotland benefits from a fiscal transfer of £2,000 per head or over £10bn annually. If you look carefully, you will see a pleasing symmetry: far from being a source of either grievance or shame, fiscal pooling & sharing within the UK has worked out remarkably equitably for Scotland over the last 40 years.

The principle of these transfers is simple enough to understand if you’ve ever split a restaurant bill: if you’re responsible for more of the bill than you end up paying, you’re effectively receiving a transfer from your fellow diners.

In the case of fiscal transfers, the bill is the deficit - the difference between public spending and tax revenues – and we split it equally by assuming UK debt and debt interest is shared on a per capita basis. How much of that deficit a constituent nation or region is responsible for therefore depends on the tax revenues it generates and the public spending it incurs.

This means that areas which benefit from fiscal transfers must do so because of lower than average levels of tax revenue generation, higher than average levels of public spending, or some combination of the two. What that combination is really matters; the implications of receiving a fiscal transfer because of relatively poor economic performance (lower tax revenue generation) are very different from those if higher public spending is the driver.

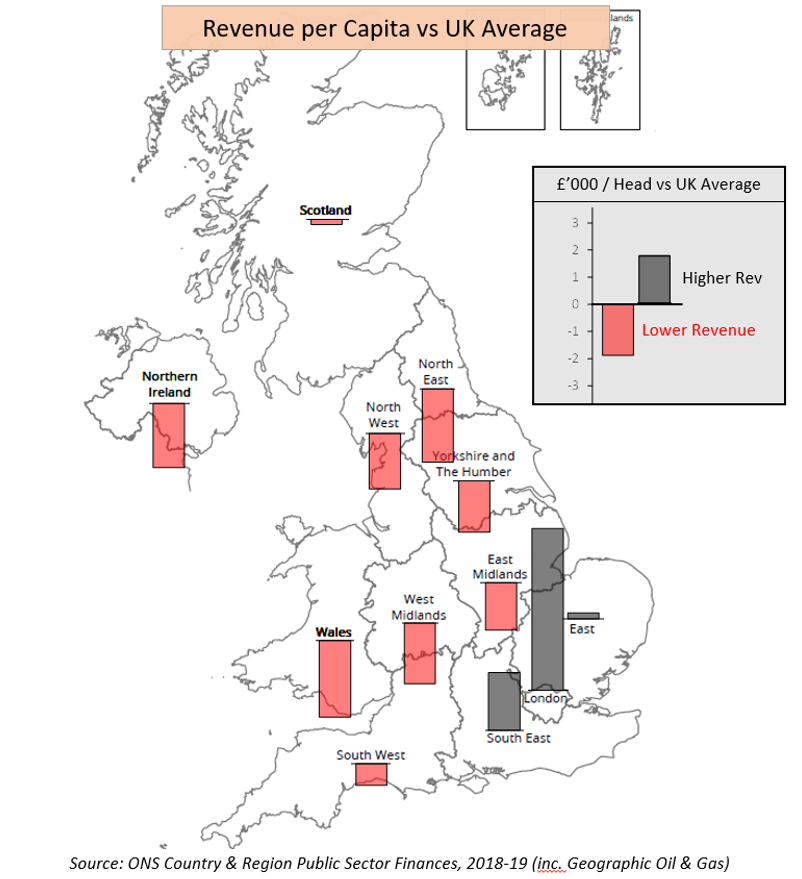

Data from the ONS Country & Region Public Sector Finances report for 2018-19 allows us to dig a little deeper and consider the wider picture. Firstly we can see which areas of the UK generate more or less tax revenue per head than the UK average.

Scotland performs relatively well on this measure compared not just to the other constituent nations but to all other regions outside London and the South East (the areas of higher than average revenue generation per head). So in this respect it’s hard to support the argument that Scotland is somehow being failed by the UK’s economic model – plenty of those red bars would be ahead of Scotland in the queue for those most in need of economic “levelling up”.

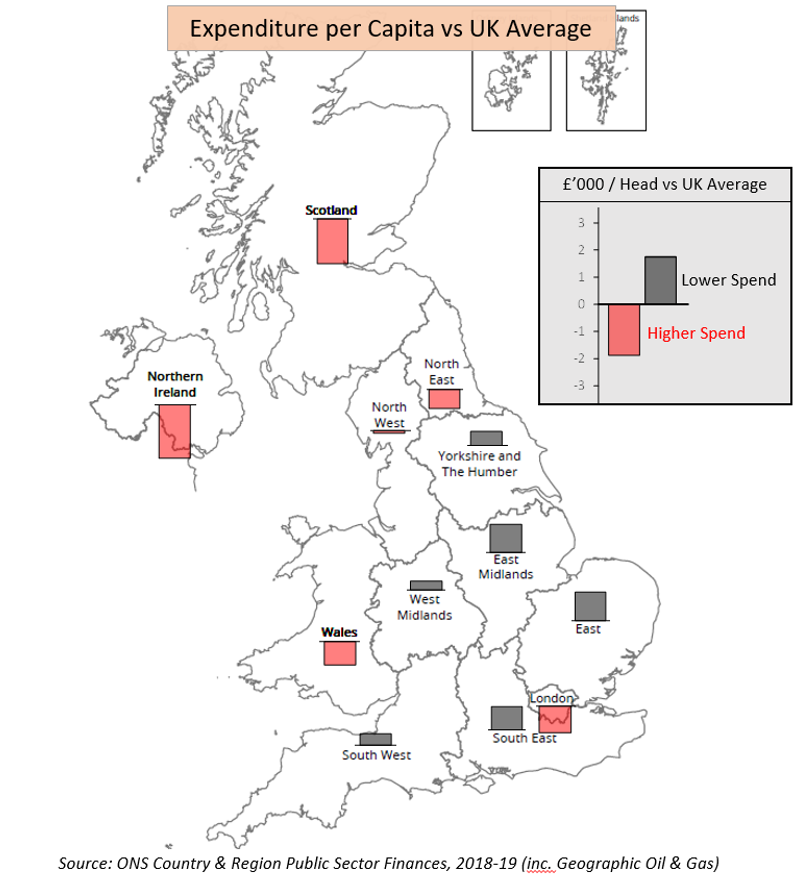

When we look at areas with higher or lower public spending per head, the picture is very different.

Scotland is second only to Northern Ireland when it comes to per capita public spending. Again it’s hard to see how, from Scotland’s perspective, receiving relatively higher levels of public spending can be seen as a failure of the UK’s economic model - yet that is the nationalists’ chosen narrative.

As an important aside: because this analysis looks at differences in spend per head between regions, costs which are themselves allocated on a per head basis (most notably defence, debt interest and foreign affairs) are by definition the same for all, so can’t explain differences. To return to our restaurant bill analogy: they are like adding a tip to the bill – it’s a real cost (and you may disagree with the group’s tipping policy) but it is not a source of any transfer between the diners.

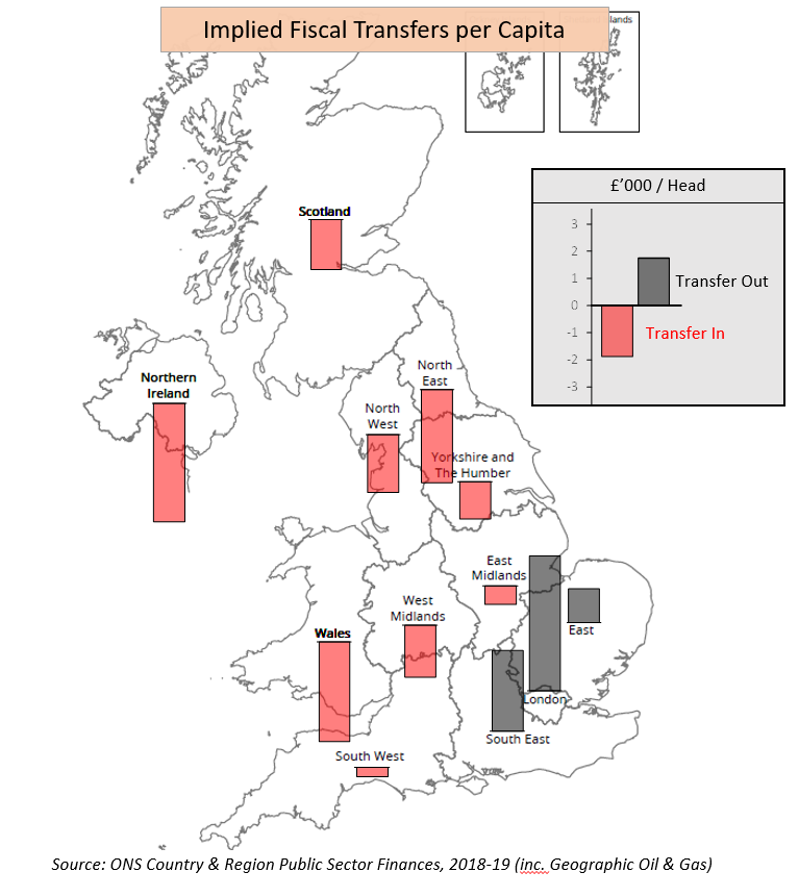

If we combine the differences in revenue generation and expenditure, we see the resulting net fiscal transfers by region.

So Scotland is not unusual in receiving a fiscal transfer and in fact Northern Ireland, Wales and the North East all receive substantially higher transfers per head. But what does set Scotland apart is that the transfer it receives is almost entirely explained by higher public spending rather than by poorer tax revenue generation.

The problem this creates for supporters of Scottish independence is obvious: leaving the UK means every man, woman and child in Scotland would be £2,000 a year worse off and – absent any remarkable economic performance improvement – drastic public spending cuts would be required (just to match the deficit level Scotland currently shares within the UK). In reality, the shock of separation from the UK (and Sterling) would be likely to both damage tax revenue generation and require Scotland to target lower deficit levels, further exacerbating the problem.

This is not just a “snap-shot” problem; higher public spending in Scotland is a long-term issue and the direction of fiscal transfers has only been reversed in the last 40 years when North Sea oil revenues have boomed. The 2014 independence White Paper ducked the issue of how Scotland’s higher public spending could be sustained by making the assumption that oil revenues would be as high as £7.9bn pa. Over the last 5 years, Scotland’s oil revenues have in fact averaged just £0.9bn pa.

But it is not just supporters of Scottish independence who should be troubled by the existence of this spending-driven fiscal transfer in Scotland’s favour. Those seeking to defend or renew the UK’s constitutional settlement are required to address a deceptively simple question: is this situation fair or sustainable?

The 1707 Act of Union has, in some respects, aged remarkably well. Clauses that remain extant today explicitly address the question of a single currency and the requirements for what we might now call the UK single market (i.e. freedom of movement, common standards, no customs borders or tariffs). But the only fiscal transfers legislated for (the Equivalent and Rising Equivalent) were put in place as transitional arrangements only. This is hardly surprising: in the early 18th century public expenditure was dominated by reserved matters which we might euphemistically refer to as “defence and foreign affairs” – funding overseas wars. Since then public spending within and directly for the UK’s constituent nations has grown massively (most obviously as a result of the creation of the welfare state) and the process of devolution has further focused attention on how this spending is distributed.

When the Barnett Formula was put in place in 1978 to determine annual changes to devolved budgets, it was intended as a temporary measure to be replaced post-devolution by some form of “needs assessment”. This has never happened and - despite many people believing that the formula inevitably drives spending convergence - in times of low absolute spending increases and slower population growth in Scotland, it has actually led to a widening of the spending gap in Scotland’s favour.

Is this fair? Unfortunately, the extent to which Scotland’s higher public spending is a function of greater need (due to lower population density and remote rural communities, demographics, pockets of endemic poverty, etc.) or simply more generous public service provision (no tuition fees, free personal care for the elderly, free prescriptions, etc.) seems to be treated as a question too politically sensitive to address. But if the union is to endure, this thistle has to be grasped – particular if further devolution and/or a federal model is to be pursued.

It may be unfashionable to defend the merits of reservation, but when citizens in devolved nations receive spending in areas which are currently reserved, this is automatically based on need. Social welfare is a prime example: if applying the UK-wide policy on pensions to Scotland’s population leads to higher average spending, that is demonstrably “fair” and happens automatically. The more spending is devolved and the more policies diverge, the harder it becomes to ensure devolved budgets are fairly based on need and the more contentious the underlying fiscal transfers become.

It can be argued that this concept of fairness based on need is the implicit moral contract which has underpinned the evolution of our unique union: we don’t require constituent nations or regions to be fiscally autonomous, we accept that spending to deliver essential public services should be based on need.

If the constitution changes without this implicit contract somehow being made explicit, we risk breaking the bonds of moral solidarity on which the future integrity of the UK depends.

This piece was first published by Reaction.

Please log in to create your comment