SCOTTISH RENEWABLES: A UNITED KINGDOM SUCCESS STORY

19 November 2021

The greatest risk to Scottish renewables does not come from a Westminster government insufficiently committed to net-zero. It comes from a Holyrood government with one overriding priority: the breakup of the United Kingdom.

Cop26 may have been a missed opportunity for the planet, but Nicola Sturgeon did not miss the opportunity to rest on her laurels. In a widely shared video, the First Minister said of Scotland: “We’ve virtually decarbonised our electricity supply. Just short of 100% of all the electricity we use is from renewable sources.”1https://www.snp.org/ambitious-climate-targets-backed-by-bold-climate-action/

Just one problem: this wasn’t true. According to the Scottish Government’s own data, 56% of the electricity used in Scotland was from renewable sources in 2020, with the rest generated by nuclear and gas plants.2https://fullfact.org/environment/scotland-renewable-energy/

Scottish renewables are a genuine success story, but they are a United Kingdom success story. Outside of the UK, Scotland could not have achieved its current scale in renewables. And without Scotland, the UK would not have made such rapid progress in reducing emissions.

The GB electricity market is separate from the electricity market on the island of Ireland, and also quite distinct. The Irish electricity market is integrated, but not fully integrated: subsidies and support do not flow in either direction across the Irish border. On the island of GB the situation is very different. Scotland exports significant quantities of electricity, and substantial net subsidies and support flow in the opposite direction: from English and Welsh bill payers to Scottish assets.

Two categories account for the majority of these flows:

-

Subsidies for generation. Selling electricity at the wholesale market price has not typically been enough to make renewables economically viable. Various subsidy mechanisms top up (or guarantee) the price at which output can be sold to a level at which the high construction costs of renewable generation assets are compensated with an adequate return. The costs of these subsidies are socialised across all GB bill payers.

-

Support for transmission. Getting electricity from where it is generated to the national grid (and onward to where there is demand) depends on transmission infrastructure. Around 40% of GB spending on transmission is expected to occur in Scotland over the next 5 years3RIIO-2 Final Determinations Electricity Transmission System Annex (REVISED) (Page 6) (Scotland’s best renewable resources are a very long way from where demand for electricity is concentrated). But those costs will not be borne in Scotland alone: they will also be socialised across all GB bill payers.

These flows are distinct from the fiscal deficit captured by the Scottish Government’s Government Expenditure and Revenue Scotland (GERS) report. The figures are not widely known and have to be unpicked from data available from Ofgem and National Grid.

The numbers are startling: the annual net flow into Scotland has been growing steadily, and now totals at least £1.2bn per annum. In 2019/20, subsidies for generation accounted for £730m and support for transmission £469m. The calculations behind these figures are detailed in an appendix to this piece.

Scotland’s Future4https://www.gov.scot/publications/scotlands-future/ (the “White Paper” manifesto for independence published by the SNP ahead of the 2014 referendum) acknowledged the vital importance of these flows by including this proposal:

As part of the planned Energy Partnership, the Scottish and Westminster Governments will have a shared objective to increase the deployment of renewable generation, requiring the continued support of consumers throughout these islands, as renewable energy competes with more established, higher carbon, forms of generation. The planned continuation of a GB-wide market will ensure that Scotland’s renewable energy resources continue to support the low carbon ambitions of the rest of the UK – supplied at the cost-effective prices that Scottish renewables can offer.

But this was cakeism long before Boris Johnson attempted to have his cake and eat it with Brexit. And the UK Government was having none of it. In 2014, the Department for Business, Energy and Industrial Strategy (BEIS) published a response5https://www.gov.uk/government/publications/scotland-analysis-energy to Scotland’s Future, which said:

In the event of independence, the integrated GB market could not continue in its current form. Decisions would be taken in the national interests of the continuing UK and its consumers and an independent Scottish state and its consumers. The UK has interconnectors that transport electricity to and from a number of countries in the rest of Europe, and is seeking to develop more. The market price is paid for power traded across these interconnectors. The UK does not currently provide financial support for network infrastructure or support generation in these other countries. When purchasing power from an independent Scottish state, the continuing UK is unlikely to be prepared to continue to make additional financial contributions – such as support for low carbon technologies – to what would be a separate country, over and above the market price for the energy in question.

The UK Government could not have been clearer. In the event of independence, Scotland becomes just like any other foreign country: rUK would continue to buy electricity from Scotland, but only pay the market price. And rUK bill payers could no longer be expected to contribute to the costs of the Scottish grid.

France is currently a net exporter of electricity to the United Kingdom. That electricity is sold into the UK at the prevailing wholesale market price. If France decided the UK market price didn’t adequately remunerate its generation assets, and also wanted some contribution to the cost of building and maintaining the French grid, it could suggest the UK pay a premium (the market price plus a subsidy) for French electricity. But it would not be a serious suggestion, and the UK would certainly not agree.

Ed Davey (now the leader of the Liberal Democrats) was Secretary of State for Energy and Climate Change when BEIS published its 2014 response. This was not the belligerent or nationalist posturing of a right-wing Conservative. It was a pragmatic and straightforward reality check: independence would take Scotland out of the fully integrated GB electricity market.

An independent Scotland only able to export electricity at the market price has a serious problem: as more and more renewables are added to the generation mix, this works to push the wholesale market price lower.

This is known as the merit order effect and it’s why talk of “subsidy free” renewables is misleading. New renewable capacity can be competitive at prices for output close to the current wholesale market price, but only if output can be sold at that price for many years into the future.

Generation assets earn a return over the long term, but wholesale electricity prices are set by short term factors. Wholesale electricity prices are where they are today only because gas is usually the marginal fuel at present.

Anyone contemplating the construction of new capacity knows that the more successful renewables are in displacing gas plants (which is the whole point of net-zero), the less profitable renewable assets will become if they receive only the wholesale market price for their output.

So the construction of new renewable capacity in Scotland will continue to depend on guaranteeing prices for output. And it will continue to depend on supporting the costs of transmission. An independent Scotland would have to find a way to pay for this support which relied upon households and businesses in Scotland alone.

Finding the missing £1.2bn per annum simply to replicate the current level of support would mean electricity bills in an independent Scotland increasing by around 35% – an extra £250 per year on the average household bill (see appendix for an explanation of this calculation). Burdening households and businesses with extra costs of that magnitude would probably be politically untenable, forcing an independent Scotland to cut support to well below what is possible within the UK.

Independence supporters typically argue that rUK would still rely on Scotland to reach its net-zero target, and would have no choice but to carry on subsidising and supporting assets in Scotland. But here's the rub: inside the UK, Scotland has been, and would continue to be, a very important part of the UK’s net-zero strategy.

Independence changes that: independent countries do not spend large sums on infrastructure in other countries. An rUK independent of Scotland could and would spend to reach net-zero inside its own borders. That would certainly mean different policies: much more on- and off-shore wind in England and Wales, probably more nuclear too. But rUK would have no need (and certainly no obligation) to support Scottish renewables.

The SNP and Scottish Greens want voters to believe that independence would unleash the full potential of Scotland’s renewable resources, but the opposite is true: independence would effectively kill the growth potential of Scottish renewables, and destroy Scotland’s opportunity to play the fullest possible role in delivering net-zero in this corner of the world.

Appendix - details behind calculations

Subsidies for generation

Three different government schemes exist to subsidise renewable generation: Renewables Obligation Certificates (ROCs), Contracts for Difference (CfD), and Feed-in Tariffs (FIT).

The largest by far is the Renewables Obligation, and this is where the significant intra-UK flows exist. ROCs have been superseded by CfDs for new capacity, but the newer scheme does not currently generate material cross border flows. The FIT scheme is very small, and of negligible importance.

The Renewables Obligation obliges suppliers to present a certain number of ROCs annually to the regulator (Ofgem). In parallel, renewable generators are allocated a certain number (which varies by generating technology) of ROCs per MWh of output sold.

Suppliers acquire the ROCs they are obliged to present to Ofgem by purchasing from generators renewable output with ROCs attached, and they pay the market price for the electricity, plus whatever the ROCs are worth.

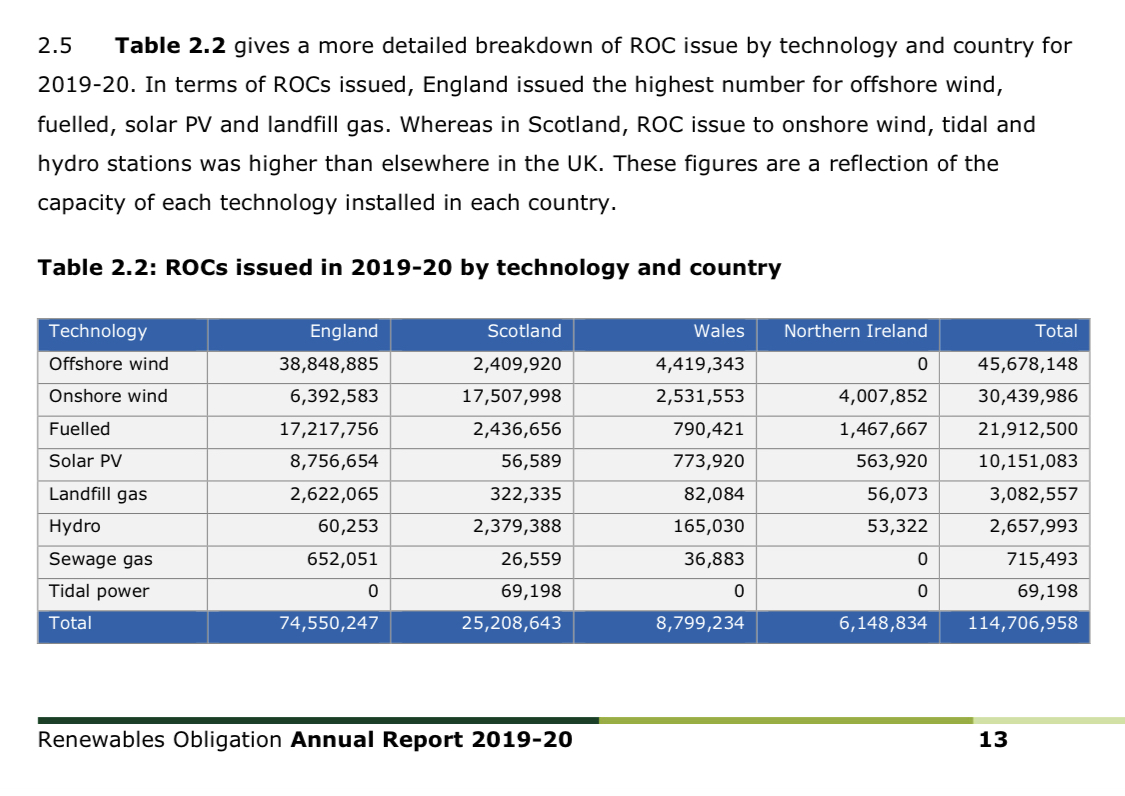

Ofgem publishes an annual report6https://www.ofgem.gov.uk/publications/renewables-obligation-ro-annual-report-2019-20 on the Renewables Obligation, which includes this table:

So, we know that 25.2m ROCs were issued to generation assets in Scotland in 2019-20.

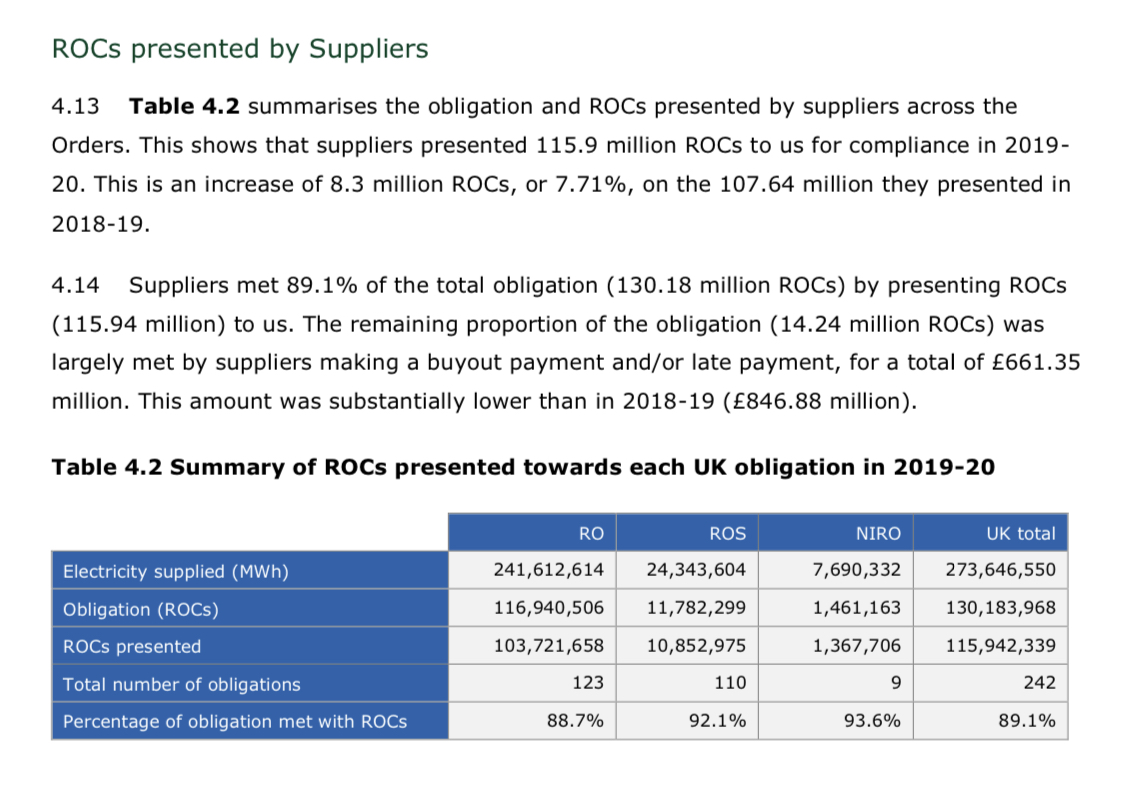

How many ROCs were supply companies obliged to present in Scotland? That information is also included in the same report:

(ROS = Renewable Obligation Scotland)

So, supply companies in Scotland were obliged to present 11.8m ROCs, and against electricity consumed in Scotland, actually presented 10.9m ROCs – slightly below the “Obligation” because the scheme is designed to be in permanent deficit, with the “buyout price" payable on any shortfall of ROCs.

This is simply the mechanism by which ROCs are guaranteed to have value: if the entire scheme is in deficit and the buyout price is set at a particular level, then ROCs are certain to be worth at least that amount (in fact slightly more since the buyout payments are recycled).

The ROC obligation is a cost to the supplier and a source of revenue for the generators. Consumers ultimately pay for ROCs via electricity bills: the ROC obligation of each supplier is passed on to its customers (if suppliers don’t pass on all of their costs, they don’t stay in business for very long).

In 2019-20, each ROC (including recycled buyout payments) was worth £54.437Renewables Obligation Annual Report 2019-20 (Page 33)

So, in Scotland:

Costs passed on via customer bills = 11.8 x 54.43 = £642m

ROC revenue to generators = 25.2 x 54.43 = £1,372m

Scotland therefore had 2019-20 ROC related inflow of:

1,372 - 642 = £730m

This was the effective subsidy paid by English and Welsh bill payers to Scottish renewable generation in 2019-20.8It is arguably more correct to use the 10.9m figure for ROCs presented to calculate the amount passed through to customer bills, since the recycling of the buyout payments means those payments are returned to suppliers, and are not a net cost at the aggregate level. However, this depends on making assumptions about supplier behaviour, so the 11.9m figure for the total obligation is used to err on the side of conservatism, since this gives the smaller net flow figure (£730m rather than £781 using the alternative calculation)

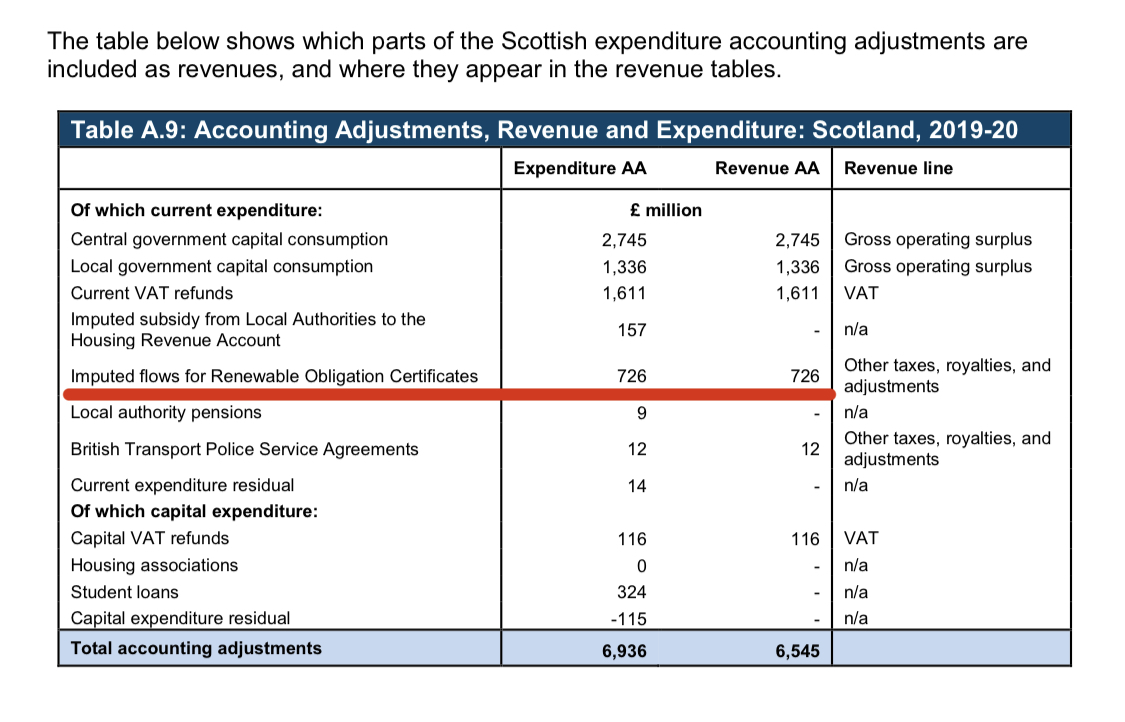

GERS aficionados might be wondering why this ROC related inflow into Scotland isn't captured by the GERS report, since ROCs are mentioned in GERS.

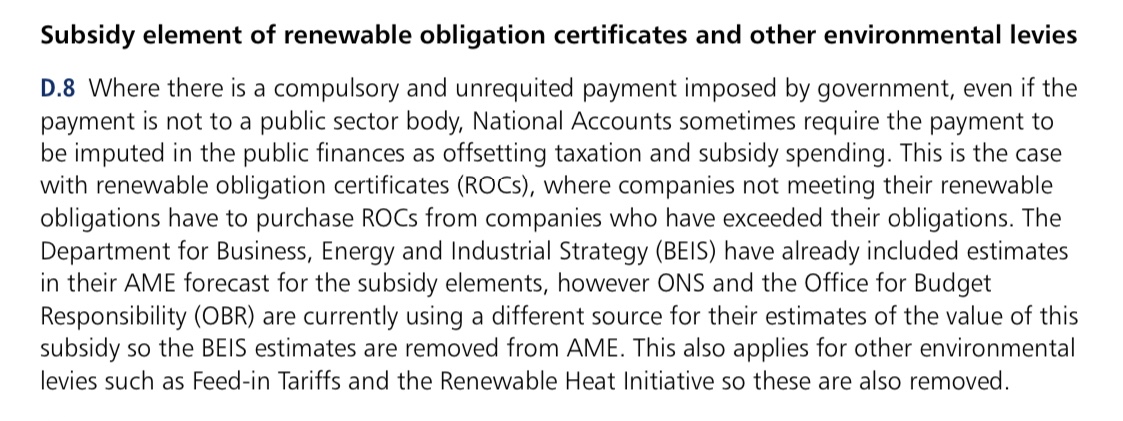

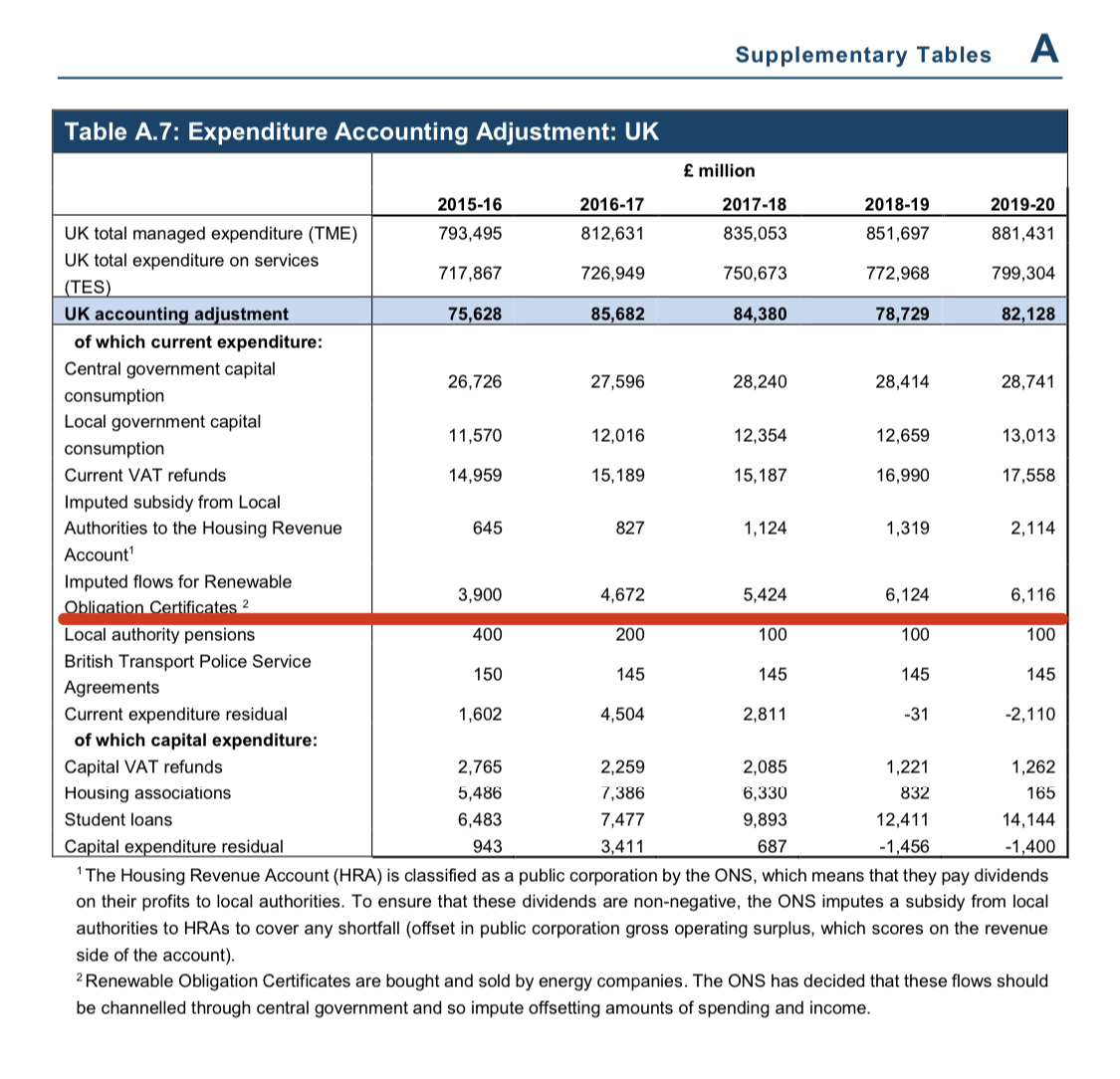

ROCs are not really government spending. They are the mechanism for a government mandated redistribution. The HM Treasury annual publication Public Expenditure Statistical Analyses9https://www.gov.uk/government/statistics/public-expenditure-statistical-analyses-2020 explains how the UK national accounts deal with ROCs. This is the relevant excerpt from the 2020 edition:

So, at a UK level, the national accounting convention is to take the entire value of the scheme and to impute that amount as exactly offsetting tax and spending components of the public finances.

Even though it isn’t what actually happens, the logic is clear: the redistribution would not occur without the government mandate, so it is precisely equivalent to a hypothecated tax imposed on one subset of the utility industry and spent on subsidising a different subset of that same industry.

But this logic fairly obviously breaks down if you zero in on a particular region or nation within the UK: the amounts collected and redistributed within any one region will not exactly offset, as the calculation for Scotland has demonstrated.

GERS, however, simply replicates the UK approach and takes Scotland's share of the exactly offsetting revenue and expenditure amounts at the UK level, and applies them to Scotland:10https://www.gov.scot/publications/government-expenditure-revenue-scotland-gers-2019-20/

Support for transmission

The costs of building and maintaining electricity transmission infrastructure are recovered via Transmission Network Use of System (TNUoS) charges, administered by National Grid.

National Grid does not own the transmission network in Scotland, which is actually two distinct networks. The North of Scotland network is owned by Scottish Hydro-Electric Transmission, and the South of Scotland network by Scottish Power Transmission. Collectively these are the Scottish TOs (transmission owners).

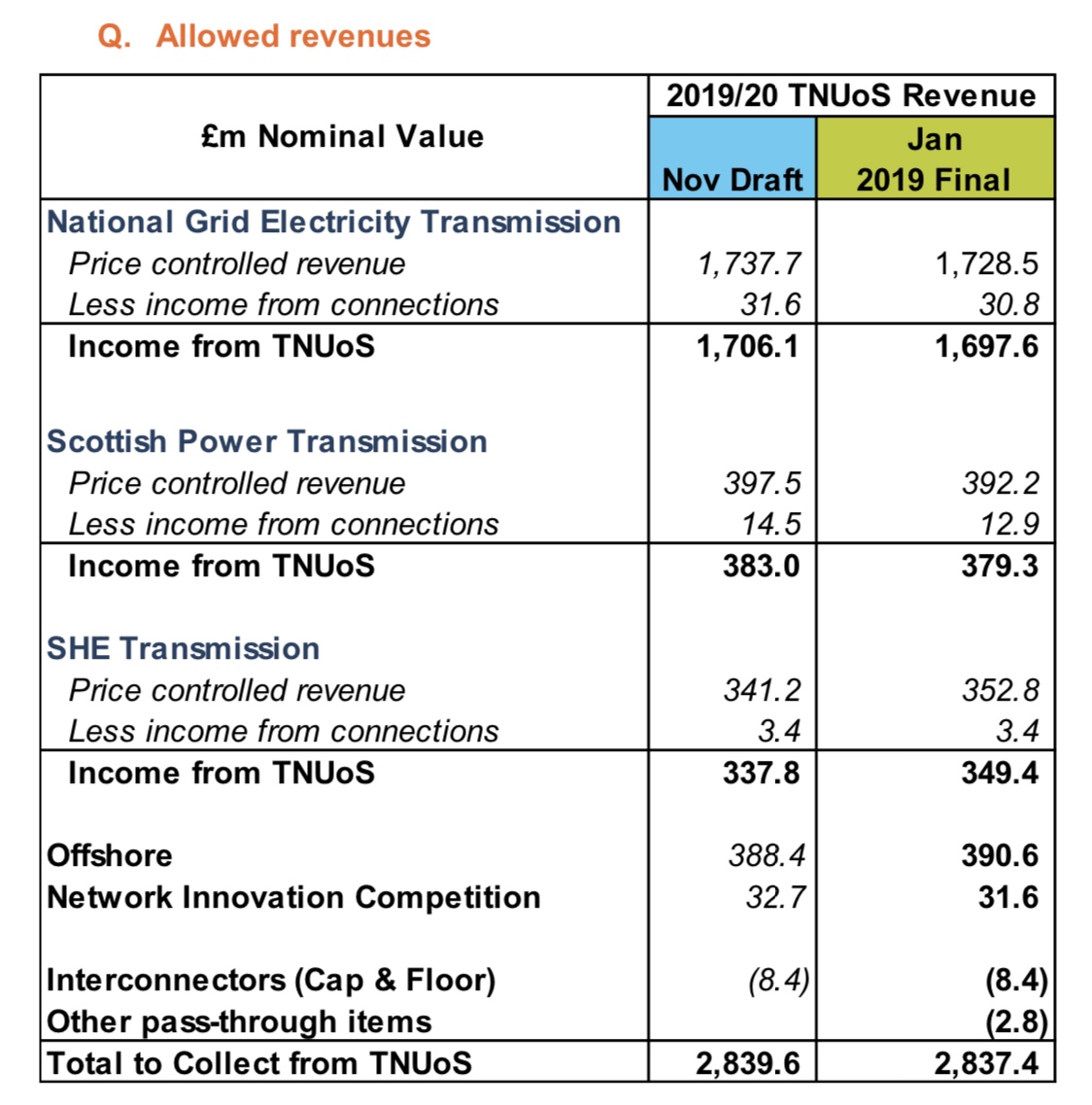

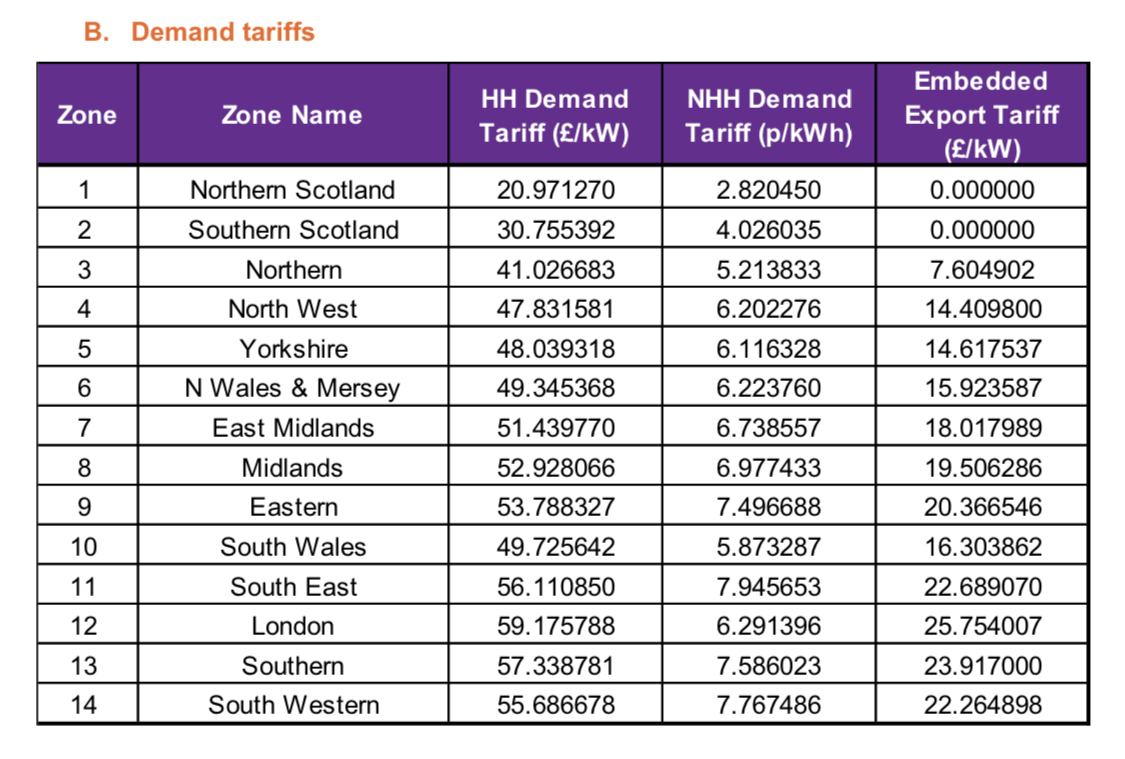

The National Grid publication Final TNUoS Tariffs for 2019/2011https://www.nationalgrideso.com/document/137351/download includes this table:

So, TNUoS passed through to Scottish TOs by National Grid to meet the costs of the Scottish Transmission networks in 2019-20 = 379.3 + 349.4 = £728.7m

Note that in 2019-20, offshore was entirely England and Wales. This will change in future years as Scottish offshore assets are added to the network. But in 2019-20, the two onshore networks in Scotland accounted for all of the revenue passed through to Scotland.

That’s the easy half of the calculation.

Discovering how much TNUoS is paid in Scotland is trickier. We know that TNUoS is paid by both generation and demand. Generators pay transmission owners for connecting to the network, and demand customers (that is the final consumers of electricity) also pay, since without transmission networks, there would be no electricity to consume.

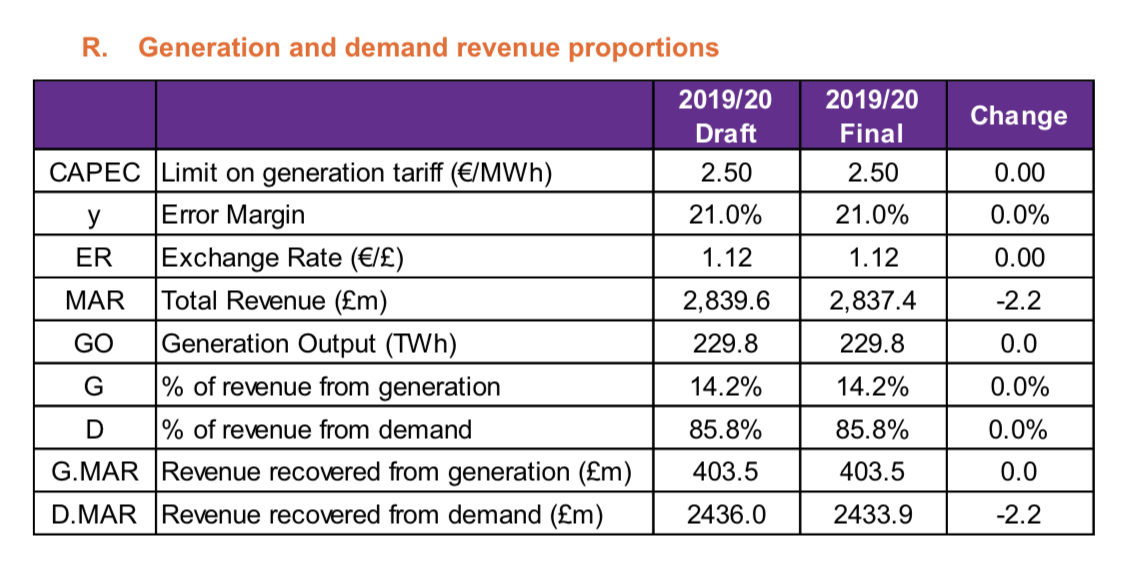

The National Grid tariff publication tells us the overall proportions recovered from generation and demand in 2019-20:

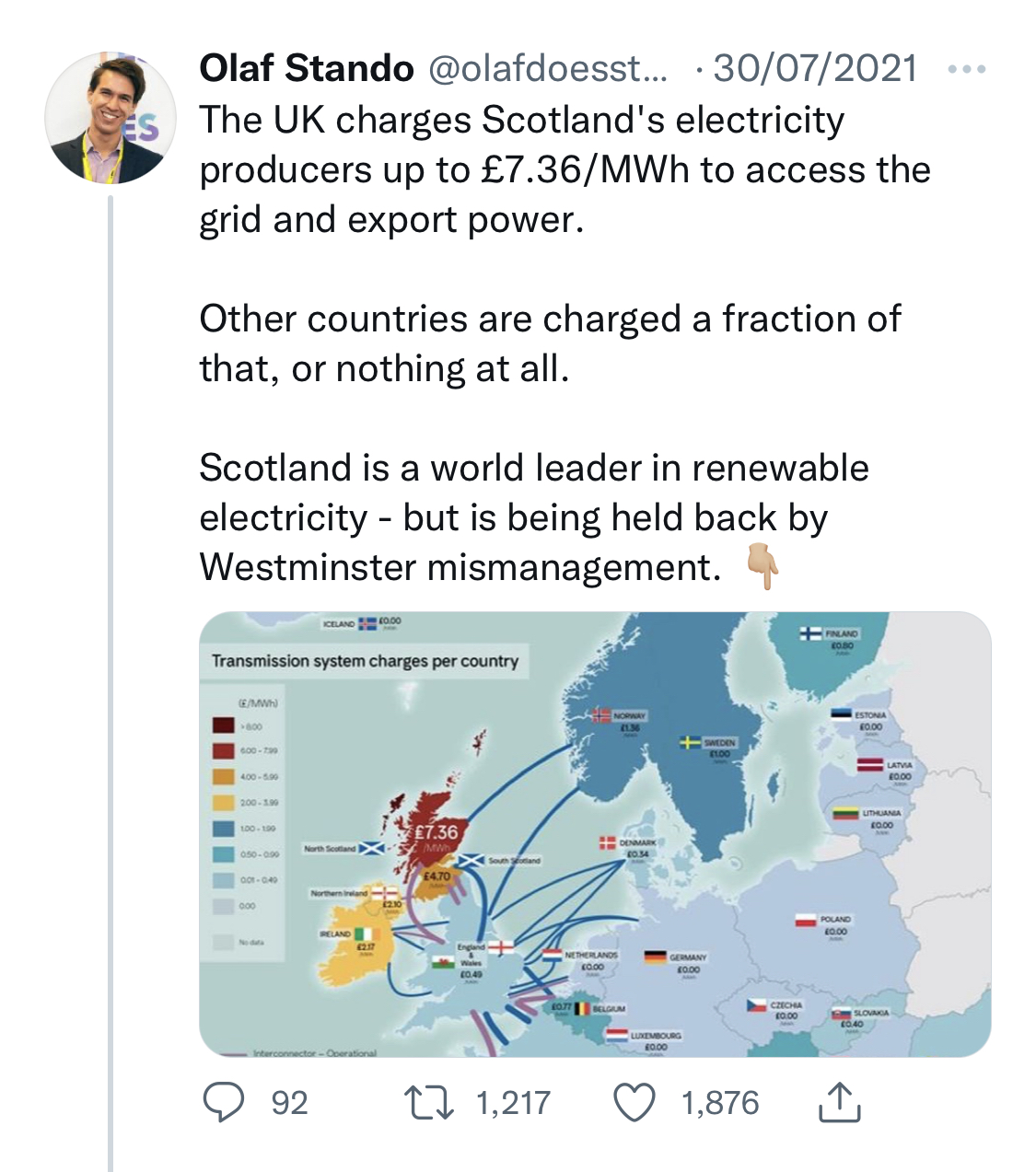

Notice that the overwhelming majority (86%) was recovered from demand in 2019-20, which is interesting context to this popular SNP grievance:12https://twitter.com/olafdoesstuff/status/1421130552518844417?s=21

Generators in Scotland do pay more than those in England and Wales to connect to the transmission network13Although there are questions about the accuracy of the figures in the graphic - a debate that is beyond the scope of this piece., but this simply reflects the reality that they are located a very long way from where demand is concentrated, and depend on more extensive (and expensive) transmission infrastructure than generators situated closer to demand. But what the SNP never mentions is that demand customers pay the overwhelming majority of TNUoS. And in Scotland, demand tariffs are much lower than in England and Wales (table from the National Grid publication Final TNUoS Tariffs for 2019/20):

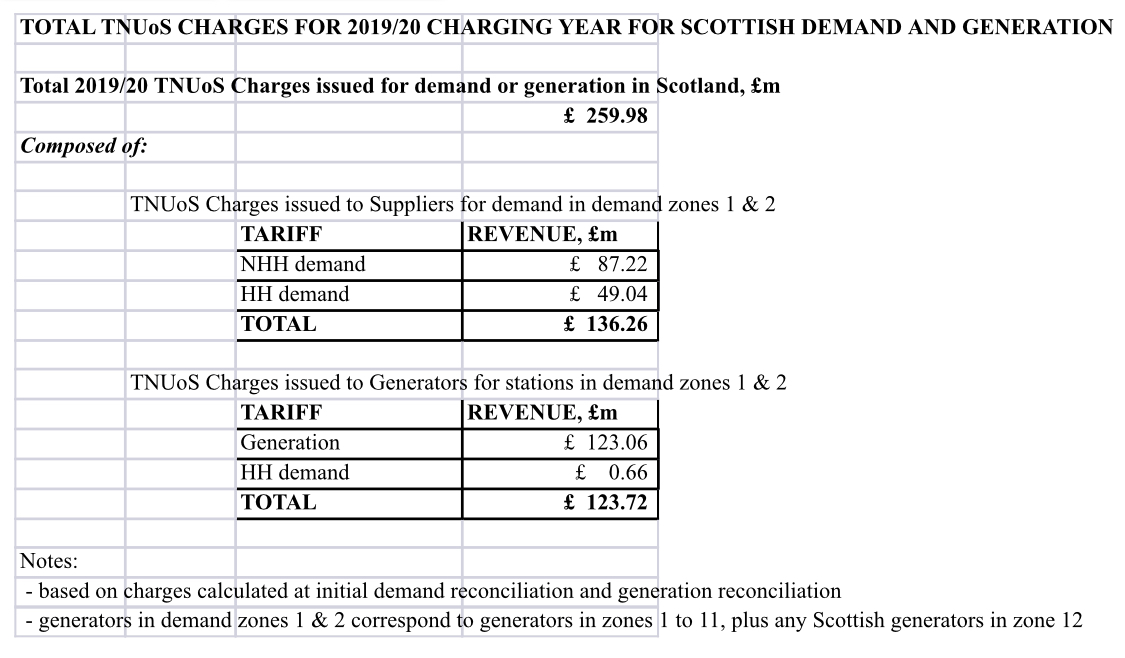

National Grid’s tariff publication details the methodology by which TNUoS charges are applied, but data on exactly how much TNUoS is ultimately paid in Scotland by generation and demand is not public. But it is available, on request, from National Grid.

National Grid sent me these figures for 2019-20:

So, total TNUoS paid by demand and generation in Scotland was £260m in 2019-20.

And the net transfer of TNUoS to Scotland in 2019-20 (from England and Wales) was therefore:

728.7 - 260 = £469m

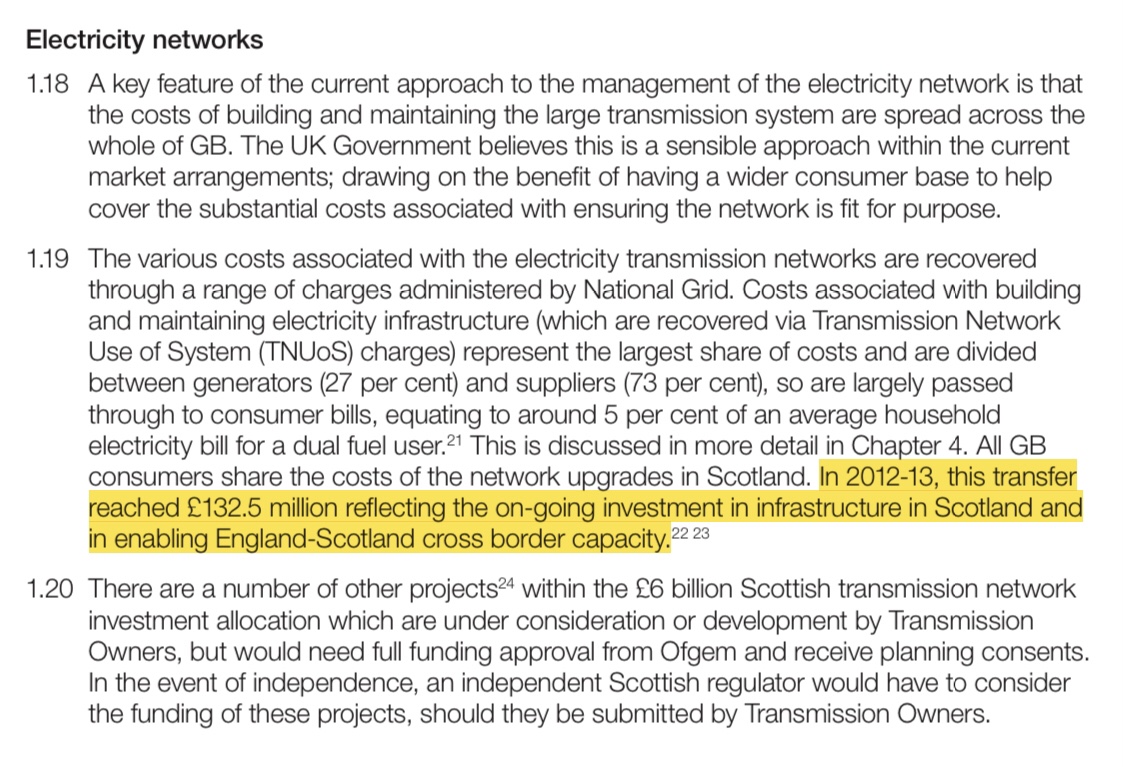

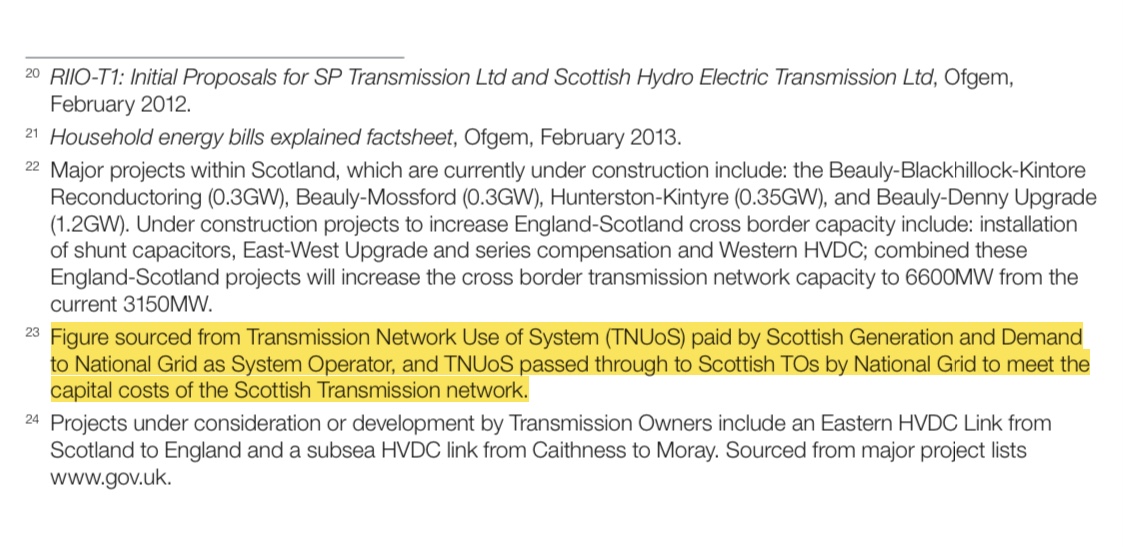

Notably, the 2014 response from BEIS to Scotland's Future did the same calculation for 2012-13, as detailed in these excerpts:

So the net transfer to Scotland has increased very substantially in just the last 7 years. And given the significant planned expenditures on Scottish transmission, that trajectory should continue (provided Scotland remains inside the United Kingdom).

Why can we say that the net transfer into Scotland was "at least" £1.2bn in 2019-20?

Subsidies for generation and support for transmission are the two most significant net transfers into Scotland relating to the GB electricity market. But they are not the only flows. The next most significant is likely to be "constraint payments" for wind farms.

Grid bottlenecks limit the amount of power that can be transmitted from one region to another and generators are sometimes asked to reduce their output, to maintain system stability and manage the flows on the network.

Generators are then compensated via a "constraint payment". These payments are volatile and difficult to forecast, but they are disproportionately made to wind farms in Scotland (with the costs socialised across all GB bill payers).14Turbines spread amid £127m bill: Scottish wind farms are the main beneficiary of compensation as the network is unable to cope with the power produced, The Times, 19th December 2019

Impact on household bills of recovering £1.2bn from within Scotland alone

Electricity consumption in Scotland is 41% domestic, 59% non-domestic.15Sub-national electricity and gas consumption summary report 2019 (BEIS publication, page 7)

On average, domestic tariffs are around 50% more expensive than the high consumption non-domestic tariffs which constitute the majority of the non-domestic consumption.16Average domestic tariffs can be found here:https://www.gov.uk/government/statistical-data-sets/annual-domestic-energy-price-statistics and average non-domestic tariffs are here:https://www.gov.uk/government/statistics/quarterly-energy-prices-december-2020 (Page 36) So, on a back of the envelope basis, it's reasonable to estimate that electricity bills paid in Scotland are split close to 50:50 between domestic and non-domestic customers.

The household component of finding £1.2bn in Scotland alone is therefore around £600m.

There are 2.37m households in Scotland.17https://www.scotlandscensus.gov.uk/census-results/at-a-glance/housing

So the average household would pay 600/2.37 = £253 more on its electricity bill.

The average annual household electricity bill in Scotland was £714 in 202018https://www.gov.uk/government/statistical-data-sets/annual-domestic-energy-price-statistics, so the percentage increase over the 2020 average would be 253/714 = 35%.

Please log in to create your comment