THE TRUTH ABOUT TIDAL

02 August 2023

Tidal power in Scotland will have the best chance of success if it can continue to defray very high startup costs across the largest possible number of consumers. And that means remaining inside the single market for electricity in Great Britain.

“SCOTLAND HAS MORE TIDAL POWER CAPACITY THAN REST OF WORLD COMBINED”

A few weeks ago that outlandish headline took up the entire front page of The National. The editor excitedly shared the story on Twitter1https://twitter.com/lauraewebsterr/status/1671789047260278786?s=46&t=y9v1mXDn2DQJqjCpgZcKXg, adding: “Another reason to support independence!”

Of course the headline was not true. It was quickly debunked on Twitter by These Islands2https://twitter.com/staylorish/status/1671797683076382720?s=46&t=y9v1mXDn2DQJqjCpgZcKXg, and later picked up by More or Less on BBC Radio 4.3https://twitter.com/staylorish/status/1673977612475985920?s=46&t=y9v1mXDn2DQJqjCpgZcKXg The National did eventually publish a correction, tucked away on page 20 of the newspaper.

Scotland actually has around 2% of the world’s total installed tidal power, but the majority of a small subset of that capacity which uses one particular technology (tidal stream). Considering Scotland has less than 0.1% of the world’s population, 2% of the installed tidal capacity is an impressive figure.

On Friday, the company which owns most of the tidal capacity in Scotland - MeyGen - published its accounts for the year to December 2022.4https://find-and-update.company-information.service.gov.uk/company/SC347501/filing-history They tell a story rather different to the one The National was pushing.

MeyGen owns a 6MW tidal array in the Pentland Firth. It has active plans to expand capacity by a further 28MW, and a longer-term aspiration to reach its full potential of 398MW.

The 6MW of installed capacity operates under the UK Government’s Renewables Obligation subsidy regime, which gives MeyGen 5 Renewables Obligation Certificates (ROCs) per MWh of output.

Bill payers across all of the United Kingdom pay for ROCs via their electricity bills. One ROC was worth about £50 in 2022.

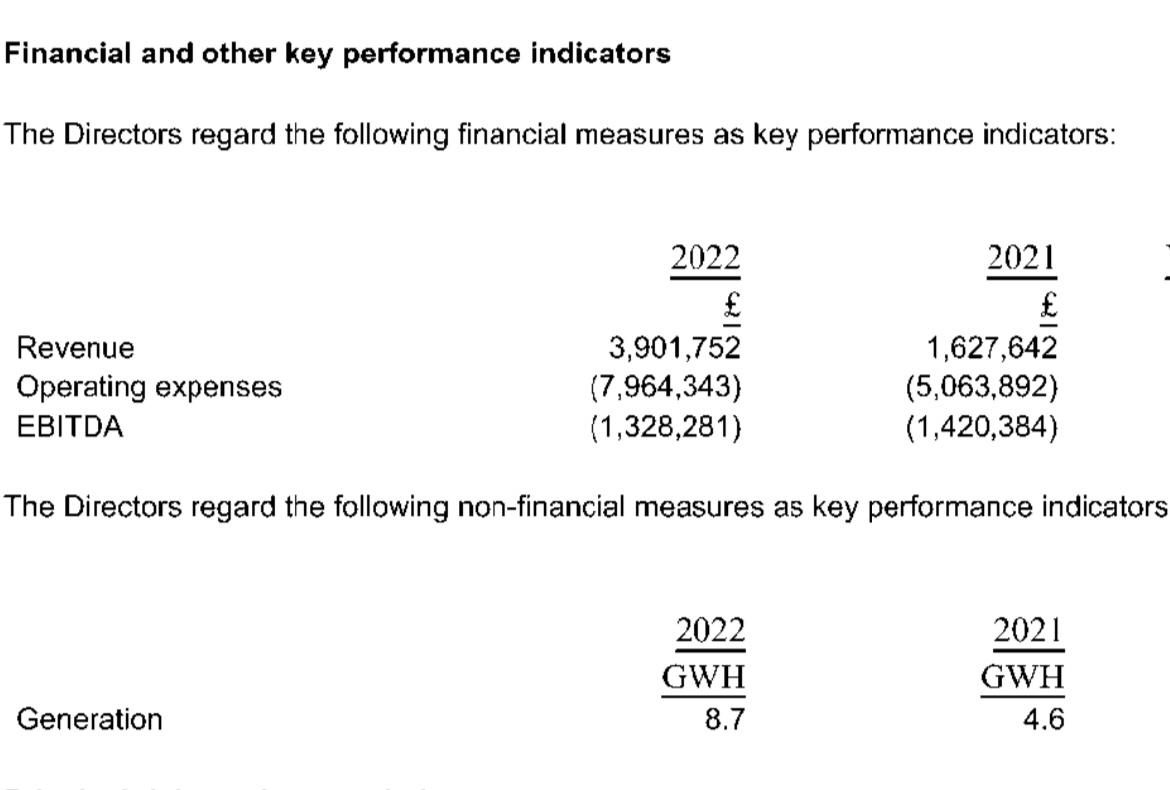

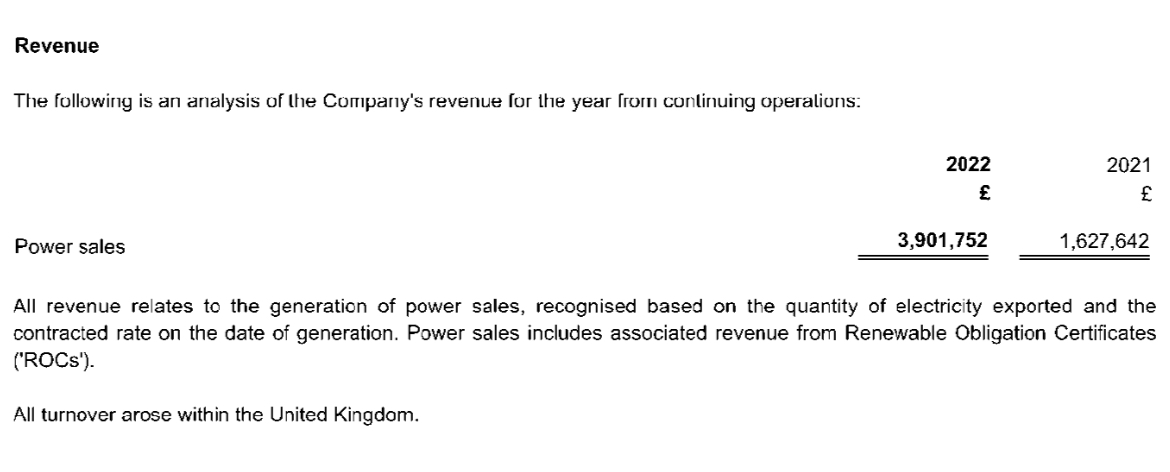

The impact of the ROCs can be seen in MeyGen’s accounts:

Dividing revenue by generation, we can calculate the average price received by MeyGen for its output in the last two financial years:

2022 = £448 / MWh

2021 = £354 / MWh

These are very high prices. In both years, MeyGen was receiving the prevailing wholesale electricity price, plus a premium of about £250 / MWh (the value of 5 ROCs).

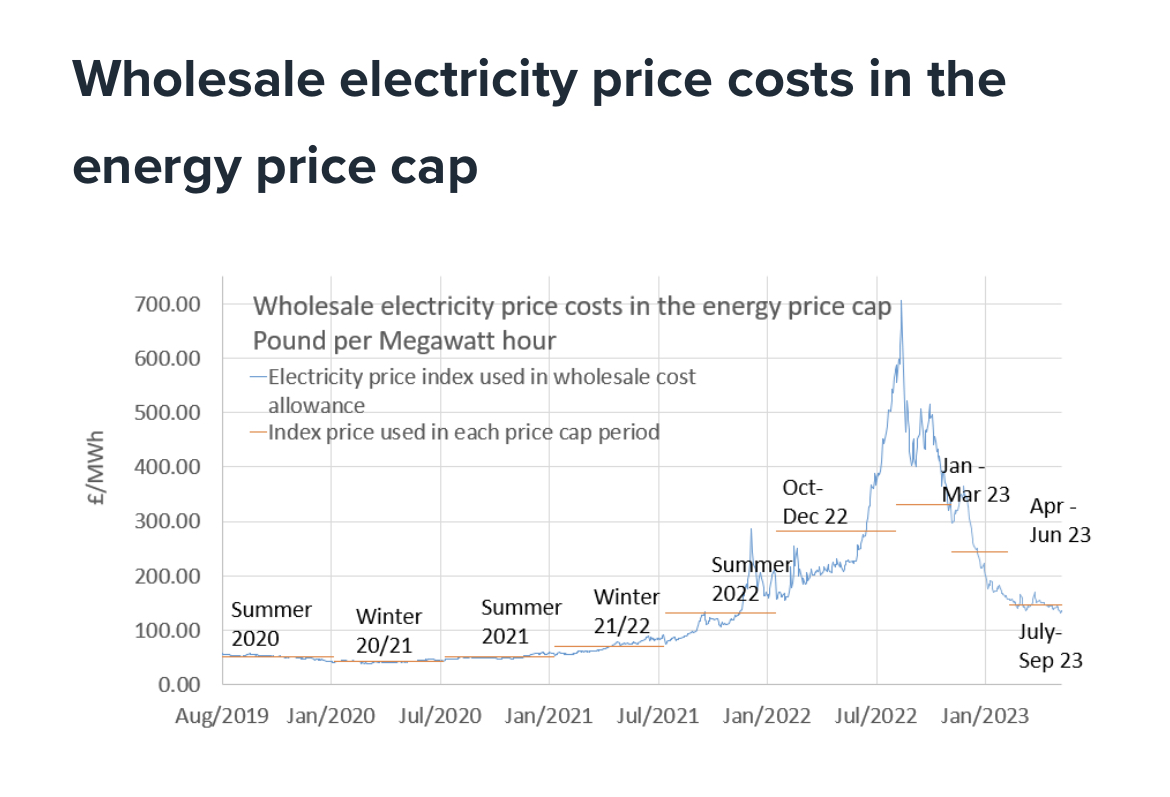

To illustrate just how high those prices are, this chart published by Ofgem5https://www.ofgem.gov.uk/publications/customers-pay-less-energy-bills-summer is useful:

The horizontal red lines indicate the wholesale electricity prices embedded in the Ofgem price caps since summer 2020.6The dates of the horizontal lines do not match the blue line - an index representing the prevailing wholesale price - because suppliers lock in prices ahead of the relevant period, via forward purchases.

The Ofgem price cap peaked in the first quarter of 2023 at £4,279 per annum for typical household consumption, when the embedded electricity price was about £330 / MWh.7https://www.ofgem.gov.uk/publications/latest-energy-price-cap-announced-ofgem

Because of the UK Government’s Energy Price Guarantee, which limited annual bills to £2,500 for typical consumption, ordinary households never actually paid bills based on the Ofgem price caps when embedded electricity prices were above £200 / MWh.

And the £400 energy bills discount meant households with typical consumption were paying around £2,100 net, annually.

The Ofgem price cap which came in at the beginning of July 2023 is £2,074 for typical household consumption, and based on a wholesale electricity price of around £150 / MWh.

So, ordinary households have never actually paid wholesale electricity prices above around £150 / MWh.

Which brings us back to MeyGen. Notice that despite receiving £448 / MWh for its output in 2022, the company was losing money (parentheses in financial accounts indicate negative numbers).

This isn’t hugely surprising, and nor is it a bad thing. Losing money in the startup phase is a downpayment on (hopefully) making it back in the future.

But these companies cannot afford to lose too much money in the early years. They need to be able to sell their output at prices high enough to get close to breaking even, buying enough time to hone the technology and create economies of scale through adding more capacity.

And MeyGen is succeeding on that front. The UK Government has replaced the Renewables Obligation with the Contracts for Difference (CfD) scheme. Instead of giving generators a premium over the prevailing wholesale market price, CfD’s give them a fixed price (adjusted for inflation) for output over a 15-year period.

MeyGen has secured a CfD for 28MW of expansion capacity at £235 / MWh8CfD allocation auctions are conducted in 2012 prices. MeyGen won a CfD at £178.54/MWh in 2012 prices, which is £235/MWh in today’s money. - still a very high price, but lower than the price at which it’s currently selling output.

But that price is still way above the highest price ordinary UK households have ever been asked to pay.

Defraying the very high startup costs of tidal power across bill payers all over the United Kingdom pushes up bills for everyone, but just a little. If those costs could be defrayed only across the much smaller population of Scotland, bills would have been, and would continue to be, higher still in Scotland.

The same story can be told about wind power. The ability to defray costs across all of the United Kingdom has been integral to Scotland’s success, in both on- and off-shore wind.

And this is why the editor of The National had it exactly back to front with her “Another reason to support independence!” tweet.

If tidal power is to flourish and reach its full potential, it will continue to depend not just on cooperation between Scotland and the rest of the UK, but integration. Separation, on the other hand, would be a significant risk to this nascent Scottish industry.

Please log in to create your comment