THE TIPPING POINT

12 January 2026

Last week, the Director of the Fraser of Allander Institute made a significant intervention on a notorious claim about income tax in Scotland. Has the SNP’s statistical chicanery finally run out of road?

To understand why the SNP is clinging to a discredited claim about income tax, it is helpful to go back to the very beginning of this long story.

On 14th December 2017, Derek Mackay delivered the Scottish Government’s 2018-19 budget to parliament, and announced the introduction of a new starter rate of income tax in Scotland. For the first £2,000 of income above the personal allowance, taxpayers in Scotland would pay 19p rather than 20p - a saving of just £20 a year.1Over the years the saving has gone up a little. It’s now worth the princely sum of £28 a year.

Why would the government bother to introduce a new tax band with such trivial consequences? The answer is evident from watching footage of that budget speech.

The starter rate tax band was a stunt, not serious tax policy. Worth almost nothing to taxpayers, it was invaluable to the SNP. Notice how delirious the SNP benches were when Mackay announced that 55% of taxpayers “will pay marginally less tax than they would if they lived elsewhere in the UK”.2Mackay deserves a small amount of credit for using the word “marginally”. That qualifier was dropped in subsequent years.

That was, and still is, the entire point of the starter rate tax band: a cheap piece of political theatre, designed to facilitate an SNP boast that the majority of taxpayers in Scotland pay less income tax than they would if they lived elsewhere in the UK.

In order to justify the claim, the Scottish Government relied on forecasts from Scotland’s independent economic and fiscal forecaster - the Scottish Fiscal Commission (SFC).

Every year the SFC forecasts the impact of the tax and spending policies in the budget, and these forecasts include an estimation of how many taxpayers fall above and below the tipping point at which taxpayers begin to pay higher income taxes in Scotland than in the rest of the UK.3Because all taxpayers in Scotland benefit from the starter rate, the tipping point at which taxpayers in Scotland pay more than in the rest of the UK occurs just above the bottom of the 21p intermediate rate band. To be precise: the same distance above the bottom of the intermediate rate band as the width of the starter rate band.

In 2018-19, the SFC forecast that 55% of taxpayers would fall below the tipping point. That meant there was a reasonably comfortable margin for error - the forecasts could be out by a little bit, and the claim that the majority of taxpayers were below that tipping point would very likely still be true.

But over the years, the claim began to rely on a smaller and smaller margin for error. By 2023-24, the SFC was forecasting that 52% of Scottish taxpayers would fall below the tipping point. In 2024-25 and 2025-26, it was 51%, giving almost no room for error at all.

And in 2023-24 and 2024-25, those small margins for error caught up with the Scottish Government. An FOI response from HMRC, published on 9th July 2025, provided figures which put the majority of taxpayers above the tipping in those two financial years.4https://www.whatdotheyknow.com/request/scottish_tax_payers#incoming-3077026 The Scottish Government’s claim - the entire point of the paltry saving created by the starter rate tax band - had turned out to be false according to HMRC figures.

This was the backdrop to a noteworthy edition of First Minister’s Questions on 2nd October 2025, during which Russell Findlay made the accurate observation that the majority of taxpayers in Scotland pay more income tax than they would if they lived elsewhere in the UK. The pomposity of John Swinney’s response has to be seen to be fully appreciated.

Swinney self-righteously (and falsely) accused Russell Findlay of misleading parliament, and then misled parliament himself, saying that: “over half of taxpayers in Scotland continue to pay less tax than if they elsewhere in the United Kingdom.”

These Islands subsequently wrote to Swinney, pointing out the HMRC figures, and asked him for an explanation for the above remark. An official in Shona Robison’s office responded, and failed even to acknowledge the existence of the HMRC data for the last two financial years. They said Swinney was entitled to say what he said because of the SFC forecasts for the 2025-26 financial year, which were published in December 2024 (alongside the budget for that financial year).5https://x.com/staylorish/status/1978120741628313784?s=46&t=y9v1mXDn2DQJqjCpgZcKXg

This was a remarkable excuse, not least because Swinney had pointedly used the phrase “continue to pay”. He was saying the claim had been true in the recent past, and would continue to be true in the future.

After the story was picked up by the media, the Scottish Government put out this statement:6https://x.com/staylorish/status/1978807228808257875?s=46&t=y9v1mXDn2DQJqjCpgZcKXg

“The SFC is the formal, statutory source of official estimates of tax and revenue for the Scottish Budget. It is a legal requirement that their estimates are adopted for revenues in the Budget.”

Apparently SFC forecasts were all that mattered, even if reality turned out differently. An extraordinary position, which prompted These Islands to submit a number of FOI requests to the SFC, asking for information on any revisions to its forecasts in light of the data made available by HMRC.

Those FOI requests were the catalyst for an SFC fact sheet, published on 11th November 2025, which updated its forecasts for median incomes and the distribution of taxpayers in Scotland.7https://fiscalcommission.scot/publications/scottish-median-incomes-fact-sheet-scottish-fiscal-commission-estimates-update-november-2025/

This fact sheet muddied the waters a little by introducing two sets of forecasts: one for gross income and another for net income (that is income after pension contributions). But the Scottish Government claim had always been about gross income, and for good reason.8This can easily be verified by cross-referencing the figures cited by the Scottish Government when making the claim against the relevant SFC forecasts.

Increasing taxes for earners in the top half of the income distribution will cause some of those taxpayers to respond by upping pension contributions. Tax policies create behavioral impacts. But behavioural impacts don’t vanish tax policies. If the Scottish Government whacks up taxes for higher earners, sheltering from the whack doesn’t mean the whack never happened.

So the Scottish Government’s claim was rightly always about gross incomes. And the SFC’s updated forecasts for gross incomes put the majority of Scottish taxpayers above the tipping points in both 2023-24 and 2024-25, meaning the claim had been false on the basis of the relevant SFC forecasts for the last two financial years.

As it happens, the new SFC forecasts also showed the claim to have been false on a net income basis in 2023-24, and it may well turn out to have been false on that basis in 2024-25 too. This will depend on further outturn data which will become available later this year. See appendix for details.

The SFC fact sheet also included a very important caveat:

“In paragraph 4 we have also sketched out a number of additional factors that could lead to variation in median income estimates between HMRC and us given the differential access to outturn data we have. There will not be a single definitive estimate of median income, even after all the outturn data is in place. In addition, individual taxpayer circumstances vary, so any one estimate of median income will not provide a definitive answer as to whether a majority of Scottish taxpayers pay less Income Tax than they would in the rest of the UK.”

This was a thinly veiled rebuke to the Scottish Government for having politicised SFC forecasts and presented them as definitive judgements.

If we go back and watch how the taxpayers claim was presented at the last three budgets, it was never caveated as relying on uncertain SFC forecasts. It was always presented as a straightforward, unchallengeable fact.

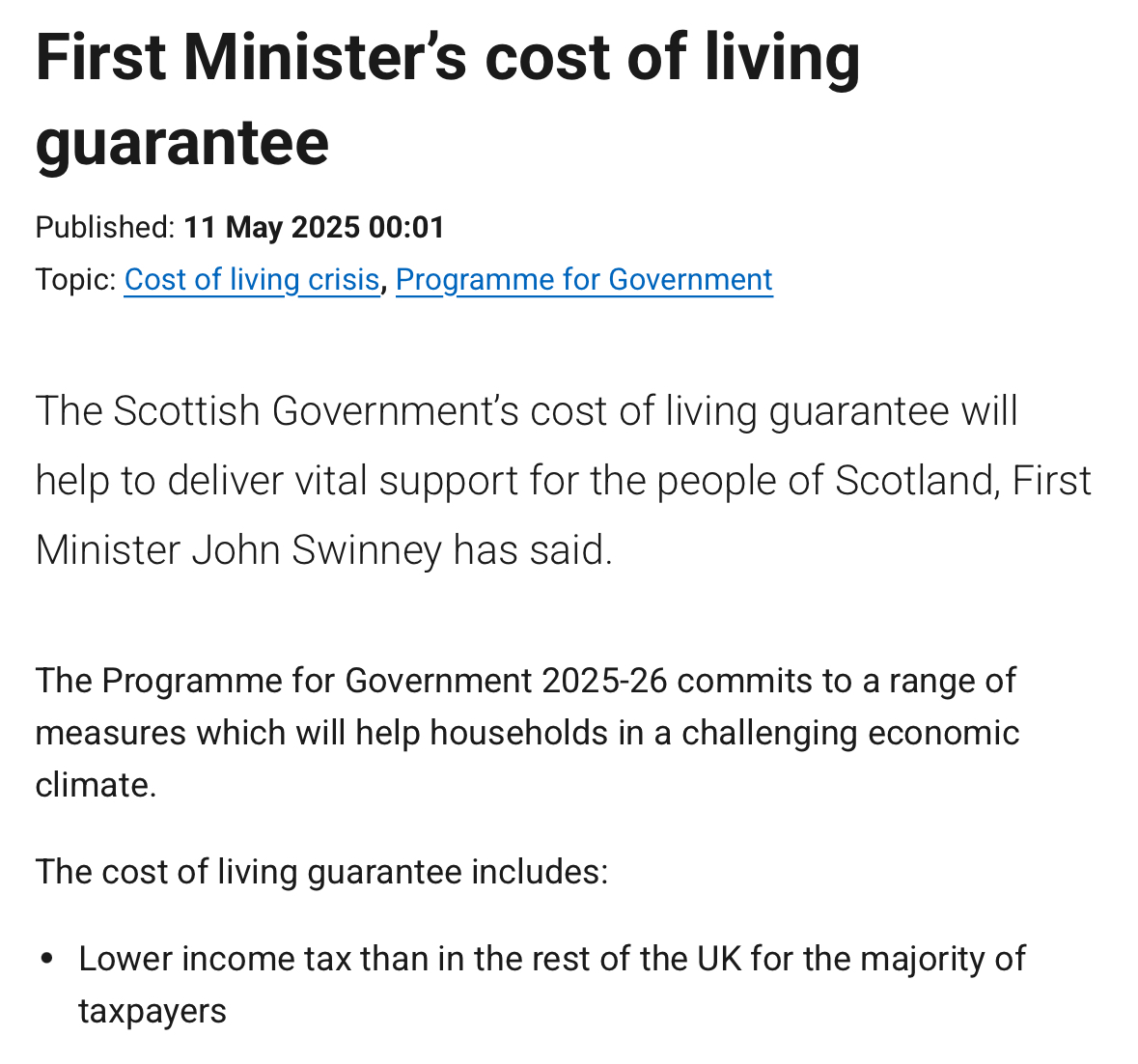

The taxpayers claim also featured prominently in the Scottish Government’s 2025-26 Programme for Government, where it was elevated to the status of a guarantee:9https://www.gov.scot/news/first-ministers-cost-of-living-guarantee/

This was, and still is, thoroughly dishonest.

The Scottish Government’s shenanigans on this matter caught the attention of the BBC Radio 4 programme More or Less, which specialises in investigating statistical chicanery. In an episode broadcast on 5th January 2026, it told an abridged version of the same story recounted here.

More or Less spoke to Mairi Spowage, the Director of the Fraser of Allander Institute, and a member of the Scottish Government’s own Tax Advisory Group. This is what Mairi said on the taxpayers claim:

“For 2023-24 and 2024-25 financial years, we can see that it is likely that the median has actually exceeded the level at which you pay more. So, for those years, it's turned out not to be true.”

The full episode of More or Less can be found here. (The segment on the taxpayers claim is 16 minutes into the programme.)

With HMRC, the SFC, and the head of Scotland’s leading economic research institute all speaking with one voice, and saying the claim has been false in the two most recent financial years, surely now the Scottish Government would level with the public and acknowledge the truth?

That has not happened. Of course it hasn’t. In the last week the Scottish Government has continued to push the claim, albeit slightly more carefully than before. It conveniently ignores the two most recent financial years, and mentions only the SFC forecasts for 2025-26, which do still predict that a very narrow majority of taxpayers will land below the tipping point this year.

But for the last two financial years reality has inconveniently diverged from SFC forecasts. To ignore this, whilst treating SFC forecasts for this financial year as sacrosanct, is underhand and unprincipled.

This government has simply invested too much political capital in this tawdry saga to tell the truth now. The cheapness of the whole charade - currently worth just £28 a year for those taxpayers lucky enough to benefit - is why the SNP cannot let go. Without the “more than half of taxpayers…” boast, the starter rate tax band would look like a pointless gimmick. And it would look like a pointless gimmick because it is a pointless gimmick.

Does it really matter whether slightly more then half, or slightly less than half of Scottish taxpayers pay a trivial amount less income tax than they would if they elsewhere in the UK? No. Of course it doesn't. It's profoundly unimportant. But the SNP is obsessed with this triviality. If they can’t tell the truth about it, then this tells us something about their integrity.

It’s not important exactly how many taxpayers in Scotland pay more or less income tax than they would if they lived elsewhere in the UK. But it is important that the government tells the truth, and is held to account when it doesn't.

Appendix

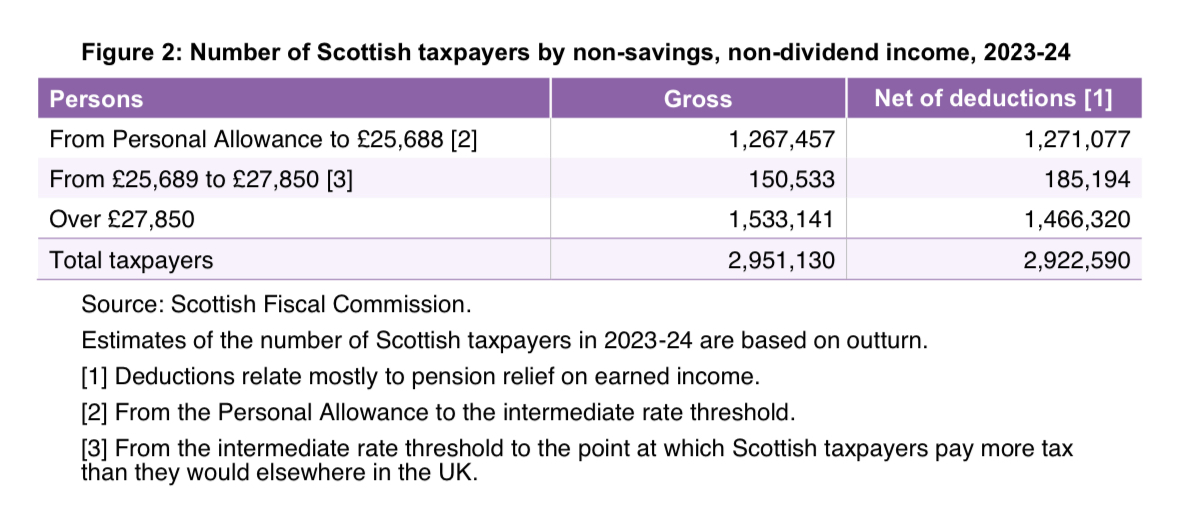

Here are the SFC figures for 2023-24 (from the fact sheet published on 11th November 2025):

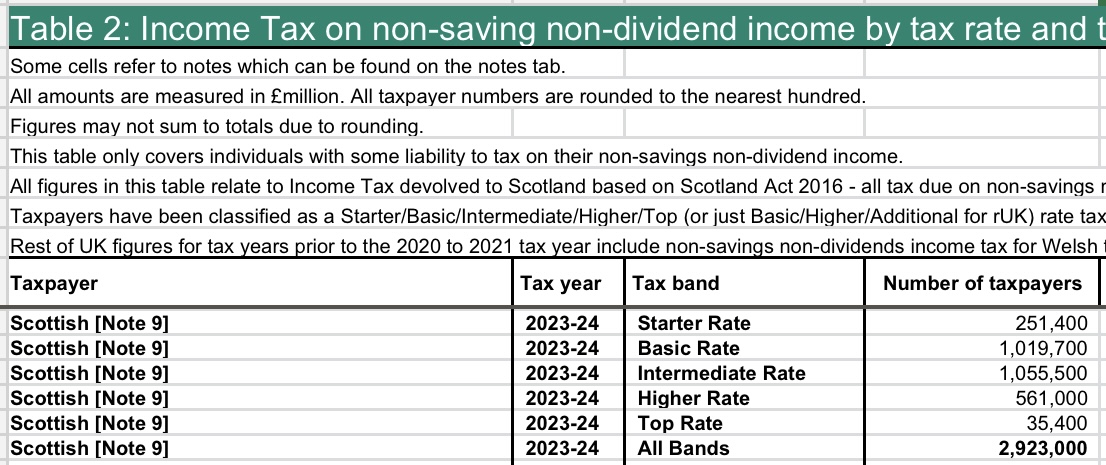

And below are the HMRC Scottish Income Tax Outturn Statistics for 2023-24. These are the figures used in the fiscal framework process which determines block grant adjustments. So this is the most recent financial year for which we have truly definitive outturn data on Scottish income tax. The official outturn statistics for 2023-24 were published by HMRC on 10th July 2025.10https://www.gov.uk/government/statistics/scottish-income-tax-outturn-statistics-2023-to-2024

So, according to the HMRC outturn figures, the number of taxpayers in the starter and basic rate bands in 2023-24 was:

251,400 + 1,019,700 = 1,271,100

Notice that this is exactly consistent (allowing for rounding) with the SFC fact sheet figure of 1,271,077 on a "net of deductions" basis for 2023-24.

So, barring an extraordinarily unlikely coincidence, we know that the HMRC outturn figures are derived on the same basis as the SFC “net of deductions” figures.

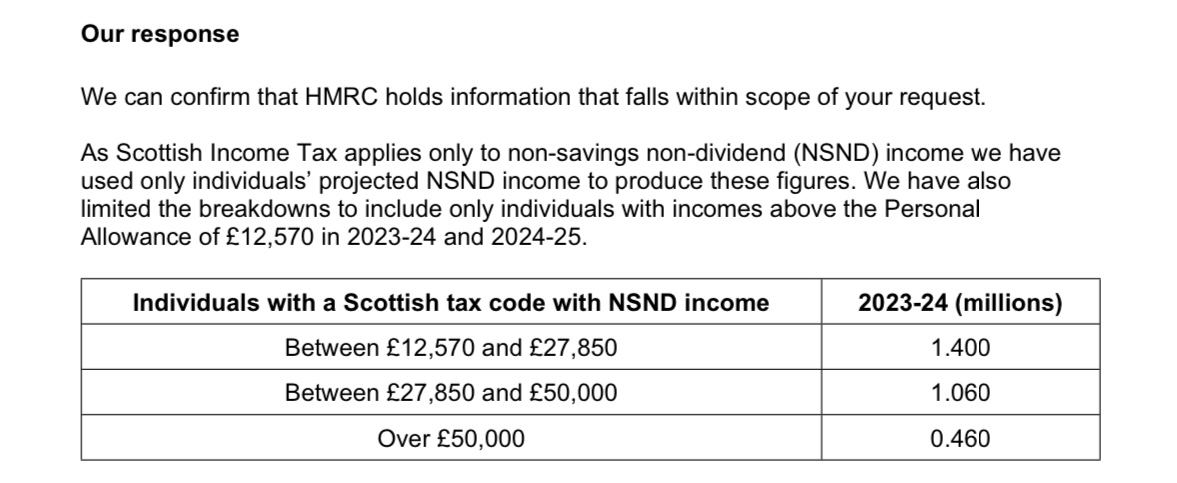

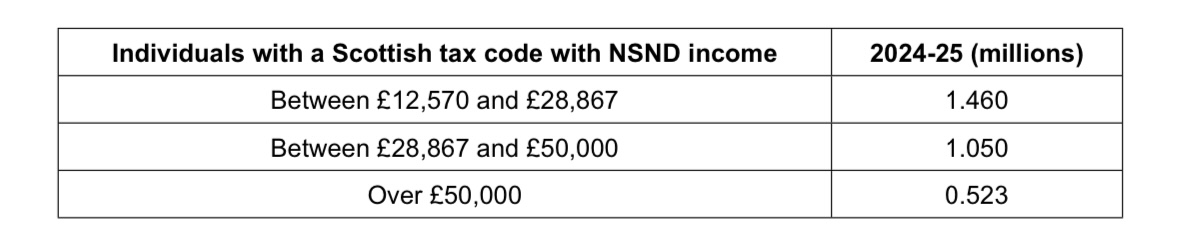

Here are the 2023-24 figures from the FOI response published by HMRC on 9th July 2025:

The only way to cross reference these figures is by summing for the total number of taxpayers:

1.4 + 1.06 + 0.46 = 2.92 million

Which is again exactly consistent with the HMRC outturn and the SFC “net of deductions” figures.

So we can be confident that these sets of figures - SFC "net of deduction", HMRC outturn, and HMRC FOI - are all calculated on the same basis, and they are in complete agreement. Note that because "net of deductions" figures are automatically lower than gross figures, we can make robust inferences about the gross numbers implied by the HMRC FOI even though the FOI response includes only "net of deductions" numbers.

For 2024-25, we currently only have two of the corresponding sets of figures.

The HMRC FOI:

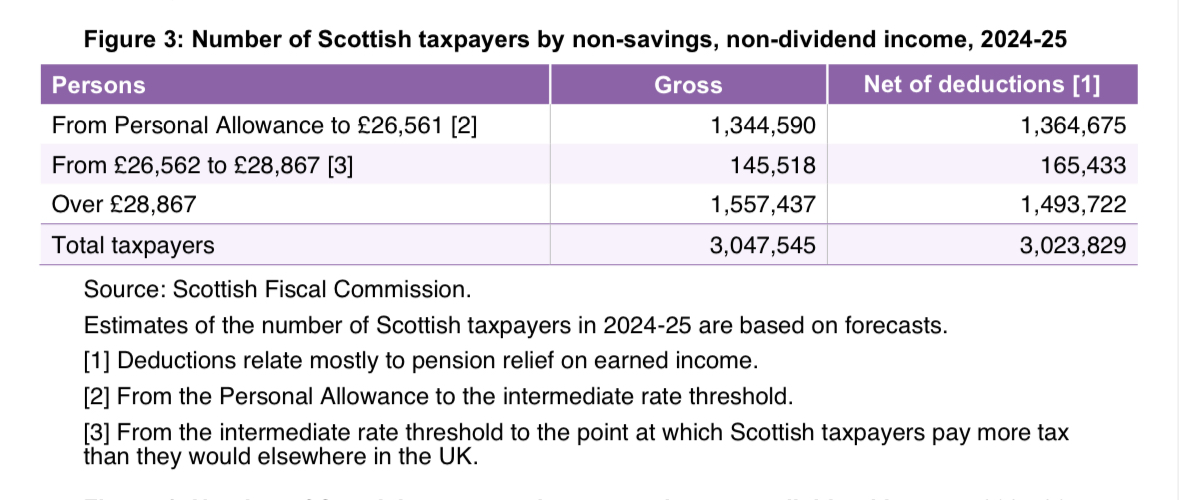

And SFC “net of deductions”:

As things stand, on a "net of deductions" basis, they disagree about 2024-25. HMRC has 1,573,000 taxpayers above the tipping point, or 51.9% of the total. The SFC has 1,493,722 above the tipping point, or 49.4% of the total.

But once we get the HMRC Scottish Income Tax Outturn Statistics for 2024-25, all three sets of figures will (as for 2023-24) come into agreement. They will have to, because the SFC cannot forecast different numbers to the settled outturn figures which feed into the fiscal framework.

There is nothing unusual about this process. Economic figures for periods in the recent past are typically revised as more data becomes available. The final HMRC Scottish Income Tax Outturn Statistics use data from HMRC's annual Survey of Personal Incomes (SPI). The 2024-25 SPI will be published in March of this year, and the HMRC Scottish Income Tax Outturn Statistics for 2024-25 will be published in July.

The divergence between HMRC and the SFC for 2024-25 is because without the 2024-25 SPI, both have had to make extrapolations from the 2023-24 SPI. The SFC has used the Public Use Tape (PUT) version of the SPI to make its own extrapolation from 2023-24 to 2024-25, which must differ from the HMRC extrapolation.

It’s possible that the HMRC outturn will come in closer to the SFC forecast than the HMRC forecast (which is effectively what the HMRC FOI response is). However, if the HMRC outturn is closer to the HMRC forecast, then the SFC "net of deductions" figures will change, and could easily tip that year into a failure vs the Scottish Government claim on the less stringent "net of deductions" basis, as well as on the gross basis on which the claim should properly be judged.

Please log in to create your comment