FOR RICHER, FOR POORER?

08 January 2024

Yesterday’s Sunday Times (7th January 2024) carried the headline “Independence will make Scottish households richer, says Yousaf”. The SNP have made similar claims before and there appears to be nothing new about this latest attempt to persuade Scots that breaking up Britain would somehow make them wealthier.

The problem for Humza Yousaf is that inviting comparisons with successful independent European countries highlights the fact that dramatic tax rises and/or public spending cuts would be required if an independent Scotland were to mimic their fiscal policies.

In 2018 the SNP’s much vaunted Sustainable Growth Commission looked at other countries with better GDP per head than Scotland and basically said “if we had their GDP per head, we’d be richer”. The Growth Commission’s report was flawed in many ways, but it did at least try to address the issue of the fiscal challenge that would come with Scotland seeking to be like any normal independent country. The conclusion the report reached was that public spending as a percentage of GDP would need to drop year-on-year until such time as an independent Scotland’s deficit was less than 3% of GDP. There’s a word for that type of fiscal strategy: austerity.

This uncharacteristic flash of honesty from the SNP was poorly received across the independence movement and the Growth Commission’s report has since sunk without trace. Search for it online today and all you will find are links to a website that has been allowed to expire.

According to the Sunday Times article “Yousaf is expected to draw heavily from a report by the Resolution Foundation”. The report being referenced is clearly A New Economic Strategy for Britain. It is a thorough and detailed piece of work which attempts to outline a UK-wide strategy for driving economic growth while sustaining tax and benefit systems which “fairly share rewards and sacrifice, as we target resilient public finances and rebuilt public services”.

That reference to resilient public finances is critical. While encouraging sustained public investment (by differentiating fiscal rules between day-to-day and capital spending) the report is clear that “A tighter fiscal policy will have to be run in good times” and recommends “a target for tax revenues to cover day-to-day spending (a current budget balance rule)”.

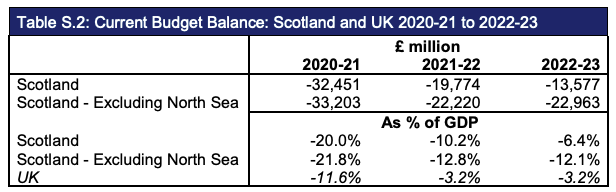

The Scottish Government’s own GERS figures1Government Expenditure and Revenue Scotland 2022-23 make clear quite how big a challenge that target would be:

Even with the benefit of what in the most recent year should be considered exceptional North Sea revenues, Scotland’s current budget balance is heavily negative and (as a percentage of GDP) far exceeds that which we share across the whole UK.

Furthermore, when looking at Italy as a case study in productivity decline, the report lists “repeated concerns over fiscal sustainability” and “political instability” as reinforcing factors:2Ending Stagnation: A New Economic Strategy for Britain, The Resolution Foundation, Figure 29, page 114

Multiple reinforcing factors appear to be responsible: the large proportion of unproductive small firms; a lack of business dynamism; poor innovation systems; inadequate workplace skills; and repeated concerns over fiscal sustainability. Then there is political instability.

Emergency governments, often dominated by ‘technocrats’, have become an almost routine response to recurrent financial crises. Backlashes have followed, with populist parties of various stripes thriving, which makes it even more difficult to embark on reform or strategic decisions to turn the country around.

Many would argue these are precisely the conditions that would exist in an independent Scotland newly separated from the UK. Conditions which would be further exacerbated by erecting a trade border with Scotland’s largest export market, breaking up the UK’s welfare state, losing the benefit of fiscal pooling and sharing, dismantling the GB energy market, creating an uncertain currency regime, unpicking shared machinery of state and defence assets and much, much more disruption.

So, the questions Humza Yousaf should be asked are simple:

-

Has he read the full Resolution Foundation report and if so, does he agree with their call for tighter fiscal policy and a rule of maintaining a current budget balance?

-

Does he accept the inevitable conclusion that to deliver the fiscal sustainability recommended by the Resolution Foundation (and to be like the countries he’s inviting comparison with) an independent Scotland would need to increase taxes and/or cut spending as a percentage of GDP?

-

Can he explain where these tax rises and public spending cuts would be made and how they would impact ordinary Scottish households?

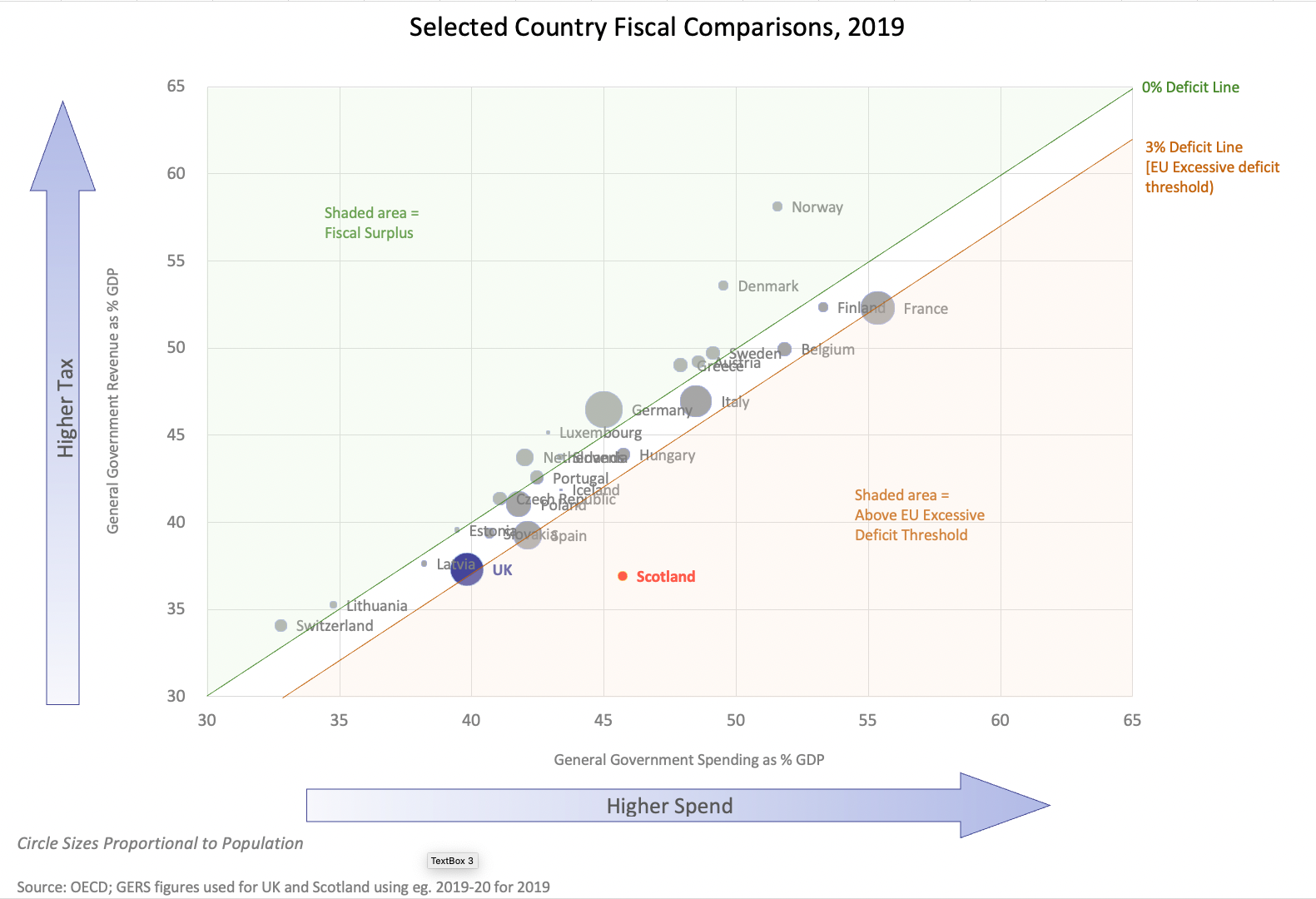

For reference: the below chart compares tax and spend as a percentage of GDP across selected European countries in 2019.3https://www.these-islands.co.uk/publications/i383/why_not_scotland.aspx Scotland is an obvious outlier: to achieve sustainable deficit levels in that (pre-pandemic) year it would have needed to dramatically increase taxes as a percent of GDP and/or reduce public spending to bring its fiscal deficit in line with all these other normal independent countries.

The need for an independent Scotland to have higher taxes and/or lower public spending than Scots are used to within the UK is so clear that one might wonder why the SNP doesn’t address the issue head on. The answer can be found in recent polling for These Islands: when we asked voters how they would vote in an independence referendum if separating from the UK would lead to them having to pay significantly higher taxes and/or would result in lower public spending in Scotland, support for independence dropped from 40% to just 27% – 31%.

Please log in to create your comment